Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost a third of its value since the end of July. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 S&P 500 stocks among hedge funds at the end of September 2018 yielded an average return of 6.7% year-to-date, vs. a gain of 2.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of ACI Worldwide Inc (NASDAQ:ACIW).

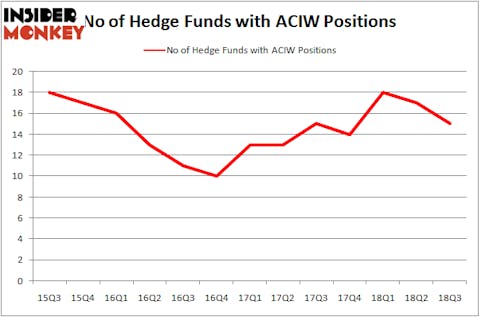

ACI Worldwide Inc (NASDAQ:ACIW) was in 15 hedge funds’ portfolios at the end of September. ACIW shareholders have witnessed a decrease in enthusiasm from smart money recently. There were 17 hedge funds in our database with ACIW positions at the end of the previous quarter. Our calculations also showed that ACIW isn’t among the 30 most popular stocks among hedge funds.

At the moment there are plenty of formulas investors have at their disposal to analyze publicly traded companies. A couple of the most innovative formulas are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the elite investment managers can outperform the S&P 500 by a superb margin (see the details here).

Let’s take a gander at the recent hedge fund action regarding ACI Worldwide Inc (NASDAQ:ACIW).

How have hedgies been trading ACI Worldwide Inc (NASDAQ:ACIW)?

Heading into the fourth quarter of 2018, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of -12% from one quarter earlier. On the other hand, there were a total of 14 hedge funds with a bullish position in ACIW at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in ACI Worldwide Inc (NASDAQ:ACIW) was held by Cardinal Capital, which reported holding $125 million worth of stock at the end of September. It was followed by P2 Capital Partners with a $106.9 million position. Other investors bullish on the company included Royce & Associates, Wallace R. Weitz & Co., and Millennium Management.

Due to the fact that ACI Worldwide Inc (NASDAQ:ACIW) has witnessed falling interest from the smart money, we can see that there is a sect of hedge funds that elected to cut their positions entirely heading into Q3. It’s worth mentioning that Jim Simons’s Renaissance Technologies dumped the largest investment of all the hedgies watched by Insider Monkey, comprising an estimated $5.3 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also sold off its stock, about $1.9 million worth. These bearish behaviors are important to note, as total hedge fund interest dropped by 2 funds heading into Q3.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as ACI Worldwide Inc (NASDAQ:ACIW) but similarly valued. These stocks are GATX Corporation (NYSE:GATX), Hillenbrand, Inc. (NYSE:HI), Horizon Pharma Public Limited Company (NASDAQ:HZNP), and Myriad Genetics, Inc. (NASDAQ:MYGN). This group of stocks’ market valuations resemble ACIW’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GATX | 11 | 267813 | 1 |

| HI | 20 | 73045 | 2 |

| HZNP | 21 | 875303 | 2 |

| MYGN | 21 | 379120 | 4 |

| Average | 18.25 | 398820 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $399 million. That figure was $298 million in ACIW’s case. Horizon Pharma Public Limited Company (NASDAQ:HZNP) is the most popular stock in this table. On the other hand GATX Corporation (NYSE:GATX) is the least popular one with only 11 bullish hedge fund positions. ACI Worldwide Inc (NASDAQ:ACIW) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HZNP might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.