Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

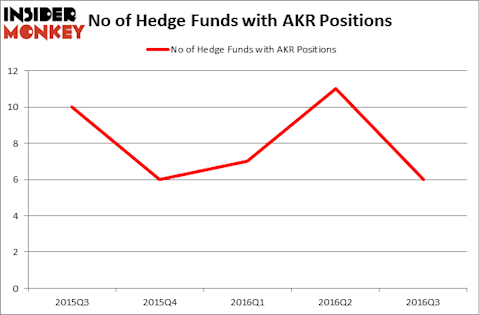

Acadia Realty Trust (NYSE:AKR) has experienced a decrease in hedge fund sentiment of late. AKR was in 6 hedge funds’ portfolios at the end of the third quarter of 2016. There were 11 hedge funds in our database with AKR holdings at the end of the second quarter. At the end of this article we will also compare AKR to other stocks including Brandywine Realty Trust (NYSE:BDN), MGIC Investment Corp. (NYSE:MTG), and Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

g0d4ather / shutterstock.com

Hedge fund activity in Acadia Realty Trust (NYSE:AKR)

At the end of the third quarter, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 45% tumble from one quarter earlier, after bullish hedge fund positions peaked at 11 at the end of June. The graph below displays the number of hedge funds with bullish position in AKR over the last 5 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Jeffrey Furber’s real estate-focused AEW Capital Management has the largest position in Acadia Realty Trust (NYSE:AKR), worth close to $69.3 million, amounting to 1.4% of its total 13F portfolio. Sitting at the No. 2 spot is Ken Fisher of Fisher Asset Management, with a $38.6 million position. Some other professional money managers that hold long positions encompass Ken Griffin’s Citadel Investment Group, Cliff Asness’ AQR Capital Management, and Richard Driehaus’ Driehaus Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Due to the fact that Acadia Realty Trust (NYSE:AKR) has witnessed declining sentiment from the aggregate hedge fund industry, logic holds that there lies a certain “tier” of fund managers that decided to sell off their entire stakes last quarter. It’s worth mentioning that Millennium Management, one of the 10 largest hedge funds in the world, got rid of the biggest stake of all the investors studied by Insider Monkey, worth close to $26.4 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund dumped about $5.3 million worth of shares.

Let’s check out hedge fund activity in other stocks similar to Acadia Realty Trust (NYSE:AKR). These stocks are Brandywine Realty Trust (NYSE:BDN), MGIC Investment Corp. (NYSE:MTG), Sinclair Broadcast Group, Inc. (NASDAQ:SBGI), and Joy Global Inc. (NYSE:JOY). This group of stocks’ market caps match AKR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BDN | 12 | 43353 | -1 |

| MTG | 36 | 545424 | -10 |

| SBGI | 32 | 346772 | -1 |

| JOY | 21 | 337414 | -1 |

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $318 million. That figure was $114 million in AKR’s case. MGIC Investment Corp. (NYSE:MTG) is the most popular stock in this table. On the other hand Brandywine Realty Trust (NYSE:BDN) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Acadia Realty Trust (NYSE:AKR) is even less popular than BDN. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock.

Disclosure: None