Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 5.7% in the 12 months ending October 26 (including dividend payments). Conversely, hedge funds’ 30 preferred S&P 500 stocks (as of June 2014) generated a return of 15.1% during the same 12-month period, with 53% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like AbbVie Inc (NYSE:ABBV).

AbbVie lost smart money support for the third-straight quarter in Q3, and nearly half of the stock’s former shareholders have sold out of it over the past three years. The formerly popular stock was nowhere near making our ranking of the 30 Most Popular Stocks Among Hedge Funds, though it has remained fairly popular among billionaire money managers, ranking 16th among the 20 Dividend Stocks That Billionaires Are Piling On. Billionaire Ken Griffin’s Citadel Advisors owned 1.54 million AbbVie shares on September 30, which sport a dividend yield of nearly 5%.

In the eyes of most investors, hedge funds are assumed to be slow, outdated financial tools of the past. While there are more than 8,000 funds in operation today, our experts choose to focus on the aristocrats of this group, approximately 700 funds. These hedge fund managers oversee the majority of the hedge fund industry’s total asset base, and by tracking their top picks, Insider Monkey has revealed a number of investment strategies that have historically outstripped the market. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 26.1% since February 2017 even though the market was up nearly 19% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

How are hedge funds trading AbbVie Inc (NYSE:ABBV)?

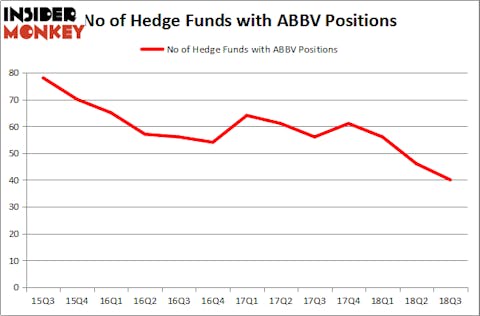

At the end of the third quarter, a total of 40 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 13% decline from one quarter earlier. On the other hand, there were a total of 61 hedge funds with a bullish position in ABBV at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in AbbVie Inc (NYSE:ABBV) was held by Orbis Investment Management, which reported holding $1.48 billion worth of stock at the end of September. It was followed by Arrowstreet Capital with a $857.2 million position. Other investors bullish on the company included AQR Capital Management, D E Shaw, and Millennium Management.

Judging by the fact that AbbVie Inc (NYSE:ABBV) has experienced a decline in interest from the entirety of the hedge funds we track, we can see that there is a sect of hedgies that slashed their positions entirely by the end of the third quarter. It’s worth mentioning that David Costen Haley’s HBK Investments sold off the biggest stake of all the hedgies followed by Insider Monkey, totaling close to $30.7 million in stock, and Robert B. Gillam’s McKinley Capital Management was right behind this move, as the fund said goodbye to about $23.3 million worth. These moves are interesting, as aggregate hedge fund interest fell by 6 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to AbbVie Inc (NYSE:ABBV). These stocks are International Business Machines Corp. (NYSE:IBM), NIKE, Inc. (NYSE:NKE), Amgen, Inc. (NASDAQ:AMGN), and Medtronic plc (NYSE:MDT). All of these stocks’ market caps are closest to ABBV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IBM | 43 | 1535227 | -3 |

| NKE | 46 | 1918057 | 10 |

| AMGN | 42 | 2892393 | 3 |

| MDT | 53 | 2507997 | 18 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 46 hedge funds with bullish positions and the average amount invested in these stocks was $2.21 billion. That figure was $3.74 billion in ABBV’s case. Medtronic plc (NYSE:MDT) is the most popular stock in this table. On the other hand Amgen, Inc. (NASDAQ:AMGN) is the least popular one with only 42 bullish hedge fund positions. Compared to these stocks AbbVie Inc (NYSE:ABBV) is even less popular than AMGN. Considering that hedge funds aren’t fond of this stock anymore, it may be a good idea to analyze it in detail and understand why AbbVie has rapidly lost favor among the smart money in recent years.

Disclosure: None. This article was originally published at Insider Monkey.