Is IQVIA Holdings, Inc. (NYSE:IQV) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

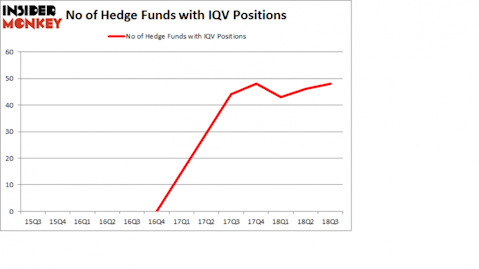

IQVIA Holdings, Inc. (NYSE:IQV) investors should pay attention to an increase in activity from the world’s largest hedge funds lately. IQV was in 48 hedge funds’ portfolios at the end of September. There were 46 hedge funds in our database with IQV holdings at the end of the previous quarter. Our calculations also showed that IQV isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the new hedge fund action encompassing IQVIA Holdings, Inc. (NYSE:IQV).

How have hedgies been trading IQVIA Holdings, Inc. (NYSE:IQV)?

At Q3’s end, a total of 48 of the hedge funds tracked by Insider Monkey were long this stock, a change of 4% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards IQV over the last 13 quarters. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Stephen Mandel’s Lone Pine Capital has the largest position in IQVIA Holdings, Inc. (NYSE:IQV), worth close to $1.0903 billion, accounting for 5.6% of its total 13F portfolio. On Lone Pine Capital’s heels is Glenview Capital, led by Larry Robbins, holding a $687.2 million position; 4.4% of its 13F portfolio is allocated to the stock. Some other peers that are bullish encompass Ricky Sandler’s Eminence Capital, Thomas Steyer’s Farallon Capital and Robert Pitts’s Steadfast Capital Management.

Now, specific money managers have been driving this bullishness. Third Point, managed by Dan Loeb, initiated the most valuable position in IQVIA Holdings, Inc. (NYSE:IQV). Third Point had $194.6 million invested in the company at the end of the quarter. Gabriel Plotkin’s Melvin Capital Management also initiated a $97.3 million position during the quarter. The following funds were also among the new IQV investors: Anand Parekh’s Alyeska Investment Group, Brandon Haley’s Holocene Advisors, and Christopher Lord’s Criterion Capital.

Let’s also examine hedge fund activity in other stocks similar to IQVIA Holdings, Inc. (NYSE:IQV). We will take a look at Discover Financial Services (NYSE:DFS), Energy Transfer Partners LP (NYSE:ETP), Imperial Oil Limited (NYSEAMEX:IMO), and Continental Resources, Inc. (NYSE:CLR). This group of stocks’ market valuations are similar to IQV’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DFS | 32 | 1061634 | 0 |

| ETP | 13 | 368219 | 0 |

| IMO | 17 | 110505 | 2 |

| CLR | 29 | 609433 | -4 |

| Average | 22.75 | 537448 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $537 million. That figure was $4.91 billion in IQV’s case. Discover Financial Services (NYSE:DFS) is the most popular stock in this table. On the other hand Energy Transfer Partners LP (NYSE:ETP) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks IQVIA Holdings, Inc. (NYSE:IQV) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.