Fundamental Valuations

Over the past three years, gross margins have consistently come in over 70%, operating margins have exceeded 35%, while profit margins stayed above 20%. These strong margins have contributed to a steadily rising cash hoard.

ISRG Operating Margin TTM data by YCharts

While Intuitive Surgical occupies a niche market with no direct competitors, let’s see how it measures up to comparable market peers, such as MAKO Surgical Corp. (NASDAQ:MAKO), which creates robotic prosthetics, and standard medical equipment maker Boston Scientific Corporation (NYSE:BSX).

| Forward P/E | 5-year PEG | Price to Sales (ttm) | Debt-to-Equity | Return on Equity (ttm) | Profit Margin | |

| MAKO Surgical | Not profitable | -0.59 | 4.68 | No Debt | -33.07% | -30.75% |

| Boston Scientific | 15.81 | 2.33 | 1.43 | 61.95 | -44.65% | -56.12% |

| Intuitive Surgical | 27.75 | 1.81 | 10.53 | No debt | 21.09% | 30.14% |

| Advantage | Boston Scientific | Intuitive Surgical | Boston Scientific | MAKO/ Intuitive Surgical | Intuitive Surgical | Intuitive Surgical |

Source:Yahoo Finance

From this comparison, we can conclude that although Boston Scientific is the most undervalued stock, but Intuitive Surgical has the most stable returns and margins, as well as the strongest potential for future growth.

Aiming for a Soft Landing

As with most growth stocks, Intuitive Surgical’s P/E and P/S ratios appear overheated, but its clean balance sheet and strong top and bottom line growth justify its higher valuation.

It’s important to remember that every growth stock must go through a transition where its P/E declines to a more sustainable level. Of course, some stocks such as Amazon.com, Inc. (NASDAQ:AMZN) grow so fast that their P/E ratios stay at extremely high levels; other companies such as Google Inc (NASDAQ:GOOG) reconcile their stock price to actual earnings so they can stably grow.

However, one fact remains constant – a decline in P/E ratio usually precedes a loss in momentum. That’s how growth stocks eventually become value stocks.

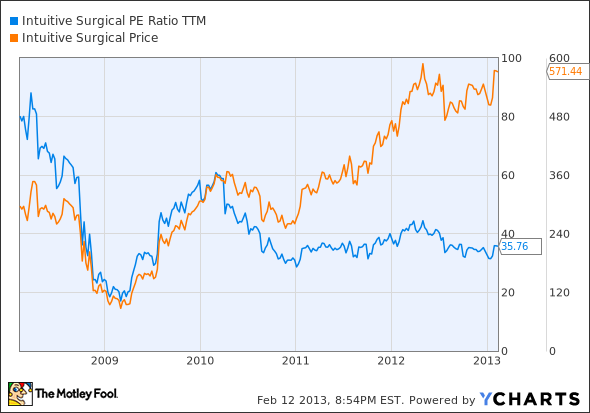

ISRG PE Ratio TTM data by YCharts

From this comparison of its P/E ratio and price change over the past five years, we can see that Intuitive Surgical’s P/E ratio stabilized in the beginning of 2011, but its price has steadily increased – which shows that the market is constantly fairly valuing the stock, despite its premium price compared to its industry peers.

The Foolish Bottom Line

Intuitive Surgical occupies an enviable position in the medical equipment market – it only makes one main product, but it has been so widely accepted and its brand so widely known that it is expanding unopposed into hospitals nationwide. The company’s incredible top and bottom line growth, coupled with strong margins, rising cash reserves and zero debt, all make Intuitive Surgical an ideal long-term investment in a technology that may become a hospital standard in the next decade.

The article Intuitive Investors Should Invest in Intuitive Surgical originally appeared on Fool.com and is written by Leo Sun.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.