World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

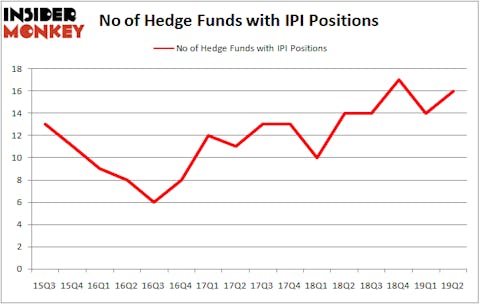

Is Intrepid Potash, Inc. (NYSE:IPI) a buy here? Hedge funds are taking an optimistic view. The number of long hedge fund bets increased by 2 lately. Our calculations also showed that IPI isn’t among the 30 most popular stocks among hedge funds (see the video below). IPI was in 16 hedge funds’ portfolios at the end of June. There were 14 hedge funds in our database with IPI positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike other investors who track every movement of the 25 largest hedge funds, our long-short investment strategy relies on hedge fund buy/sell signals given by the 100 best performing hedge funds. Let’s take a glance at the recent hedge fund action regarding Intrepid Potash, Inc. (NYSE:IPI).

What does smart money think about Intrepid Potash, Inc. (NYSE:IPI)?

Heading into the third quarter of 2019, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in IPI over the last 16 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

The largest stake in Intrepid Potash, Inc. (NYSE:IPI) was held by Royce & Associates, which reported holding $8 million worth of stock at the end of March. It was followed by Prescott Group Capital Management with a $5.3 million position. Other investors bullish on the company included Perella Weinberg Partners, Marshall Wace LLP, and Wallace Capital Management.

Consequently, key money managers have jumped into Intrepid Potash, Inc. (NYSE:IPI) headfirst. Perella Weinberg Partners, initiated the most outsized position in Intrepid Potash, Inc. (NYSE:IPI). Perella Weinberg Partners had $4.1 million invested in the company at the end of the quarter. Renaissance Technologies also initiated a $0.3 million position during the quarter. The only other fund with a new position in the stock is Bruce Kovner’s Caxton Associates LP.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Intrepid Potash, Inc. (NYSE:IPI) but similarly valued. We will take a look at Sierra Wireless, Inc. (NASDAQ:SWIR), Diplomat Pharmacy Inc (NYSE:DPLO), PDF Solutions, Inc. (NASDAQ:PDFS), and Synthorx, Inc. (NASDAQ:THOR). This group of stocks’ market valuations match IPI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SWIR | 10 | 66704 | -2 |

| DPLO | 8 | 70605 | -6 |

| PDFS | 8 | 25148 | -1 |

| THOR | 7 | 232971 | 2 |

| Average | 8.25 | 98857 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.25 hedge funds with bullish positions and the average amount invested in these stocks was $99 million. That figure was $30 million in IPI’s case. Sierra Wireless, Inc. (NASDAQ:SWIR) is the most popular stock in this table. On the other hand Synthorx, Inc. (NASDAQ:THOR) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Intrepid Potash, Inc. (NYSE:IPI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately IPI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on IPI were disappointed as the stock returned -2.7% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.