The strategy

The Dogs strategy involves buying and holding equal dollar amounts of the 10 best-yielding dividend stocks of the Dow Jones Industrial Average (Dow Jones Indices:.DJI). The strategy banks on the idea that blue-chip stocks with high yields are near the bottom of their business cycle and should do much better going forward. Investors in the strategy then would get not only large dividends but also gains in the stocks underlying those dividends.

High-yield dividends

High-yield portfolios are often dismissed as inferior to their growth counterparts for various reasons:

Many people fear that increasing dividend yields mean lower portfolio returns.

Others believe that dividend payments mean that management believes the business is done growing.

Evidence from Tweedy, Browne refutes these falsehoods. Research shows that portfolios of high-yield dividend stocks outperform lower-yielding portfolios and the market in general. In fact, a study by noted finance professor Jeremy Siegel found that over 45 years, the highest-yielding 20% of S&P 500 stocks outperformed the S&P 500 by three times! The highest-yielding stocks turned a $1,000 investment in 1957 into $462,750 by 2002, compared with $130,768 if the same money was invested in the index.

Performance

After beating the Dow Jones Industrial Average (Dow Jones Indices:.DJI) by 6.8% in 2011, the Dogs underperformed the Dow by 0.2% in 2012.

Check out the Dogs’ performance in 2013 so far:

| Company | Initial Yield | Initial Price | YTD Performance |

|---|---|---|---|

| AT&T | 5.34% | $33.71 | 12.50% |

| Verizon | 4.76% | $43.27 | 24.74% |

| Intel Corporation (NASDAQ:INTC) | 4.36% | $20.62 | 17.84% |

| Merck | 4.20% | $40.94 | 13.42% |

| Pfizer | 3.83% | $25.08 | 16.49% |

| DuPont | 3.82% | $44.98 | 25.37% |

| Hewlett-Packard | 3.72% | $14.25 | 50.21% |

| General Electric | 3.62% | $20.99 | 12.68% |

| McDonald’s | 3.49% | $88.21 | 16.05% |

| Johnson & Johnson (NYSE:JNJ) | 3.48% | $70.10 | 26.68% |

| Dow Jones Industrial Average | 13,104 | 17.17% | |

| Dogs of the Dow | 21.60% | ||

| Dogs Return vs. Dow (Percentage Points) | +4.43% |

Source: S&P Capital IQ as of April 18.

This week, the Dow Jones Industrial Average (Dow Jones Indices:.DJI) was up 1.58%. The Dogs rose less than the Dow, moving down 0.87 percentage points. That brings the Dogs’ outperformance down to 4.3 percentage points better than the Dow.

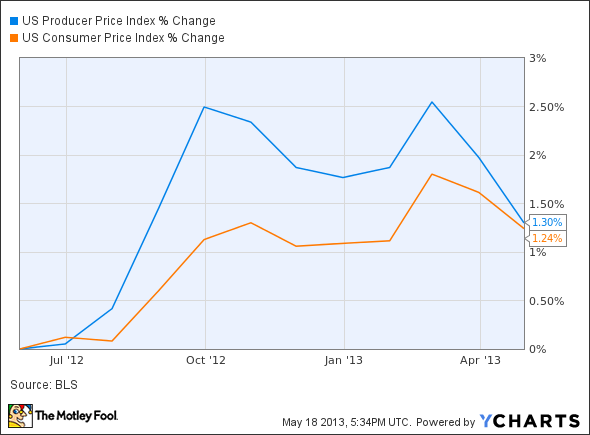

There were a bunch of economic reports and some other extraneous factors boosting the Dow Jones Industrial Average (Dow Jones Indices:.DJI) this week. The Dow’s momentum continues to carry it up and was boosted this week by better-than-expected retail sales on Monday. Later in the week, inflation reports for both consumers and producers were below the Federal Reserve’s target of 2%, which bodes well for the government’s continuing of its bond buying.

US Producer Price Index data by YCharts