We recently compiled a list of the 15 AI News and Ratings Trending on Financial Media. In this article, we are going to take a look at where Intel Corporation (NASDAQ:INTC) stands against the other AI stocks that are trending on financial media.

Latest reports from finance news publication The Wall Street Journal reveal that xAI, the AI startup founded by billionaire Elon Musk, is on track to surpass $100 million in annual revenue and could release a standalone app for its Grok chatbot as soon as next month. Per the report, the vast majority of the revenue comes from other companies that Musk chairs, as Grok is only available to users of the X social network, and it has been used as a customer service feature for the Starlink internet service. Grok is competing with other AI chatbots like ChatGPT and Gemini, among others.

Read more about these developments by accessing 10 Best AI Data Center Stocks and 10 Buzzing AI Stocks According to Goldman Sachs.

Meanwhile, Chinese firm ByteDance, the parent company of social media platform TikTok, is reportedly suing a former intern for $1.1 million, alleging he deliberately attacked its artificial intelligence large language model training infrastructure. According to a report by news agency Reuters, the case has drawn attention due to its focus on AI LLM training, a technology that has captured global interest amid rapid technological advances in so-called generative AI, used to produce text, images or other output from large bodies of data. The intern is alleged to have deliberately sabotaged the model training tasks through code manipulation and unauthorized modifications.

Read more about these developments by accessing 30 Most Important AI Stocks According to BlackRock and Beyond the Tech Giants: 35 Non-Tech AI Opportunities.

For this article, we selected AI stocks by combing through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

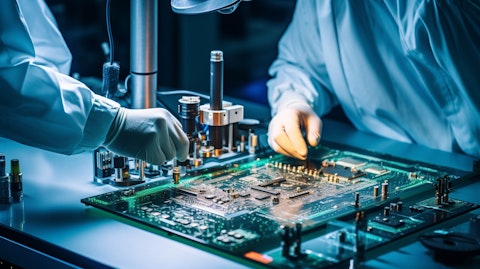

A technician soldering components for a semiconductor board.

Intel Corporation (NASDAQ:INTC)

Number of Hedge Fund Holders: 68

Intel Corporation (NASDAQ:INTC) markets key technologies for smart devices. Latest filings from the chipmaker reveal that under a recent deal with the federal government, the company has been mandated to spend at least $35 billion on research and development in the US from 2024 through 2028. The deal, worth around $8 billion in government subsidies, also tasks the chipmaker with building, equipping, and operating 12 fabs and advanced packaging facilities located in Arizona, New Mexico, Ohio, and Oregon.

Overall INTC ranks 8th on our list of the AI stocks that trending on financial media. While we acknowledge the potential of INTC as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than INTC but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 8 Best Wide Moat Stocks to Buy Now and 30 Most Important AI Stocks According to BlackRock.

Disclosure: None. This article is originally published at Insider Monkey.