In the month of October, there have been several notable insider sales of stocks that pay dividends. In this article we are taking a closer look at the following 5 stocks: The Clorox Company (NYSE:CLX), Bristol-Myers Squibb Company (NYSE:BMY), Raytheon Co.(NYSE:RTN), Illinois Tool Works (NYSE:ITW), and Yum! Brands Inc. (NYSE:YUM). This is the second part of our article (read the first part here).

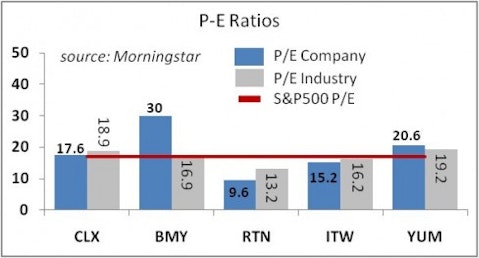

Raytheon Co. (NYSE:RTN) is an $18.5-billion aerospace and defense company. It is the world’s largest missile maker and the sixth largest defense contractor. Raytheon is currently paying a dividend yield of 3.6% on a low payout ratio of 35%. Peers Lockheed Martin Corporation (NYSE:LMT) and General Dynamic (NYSE:GD) are paying dividend yields of 4.8% and 3.0%, respectively. Over the past five years, Raytheon’s EPS and dividends grew at average rates of 14.9% and 14.0% per year, respectively. EPS growth is forecast to average 8.6% per year for the next half decade. While the company is facing some headwinds from lower defense spending and the impending fiscal cliff in the United States, Raytheon is still well positioned to weather the medium term risks to its growth. Notwithstanding decelerating EPS growth, this company is still expected to grow faster than the U.S. economy over the next several years. The company has seen expanding margins (for five quarters in a row). It is also benefiting from cost cuts and productivity gains that are likely to continue in the future. The company has a majority of contracts on a fixed price basis. Raytheon is benefiting from its international expansion, recording higher orders that generally have higher profit margins. Raytheon boasts a free cash flow yield of 5.2%, ROE of 21% and ROIC of 15%. As regards its valuation, on a forward P/E basis, the stock is priced on par with its respective industry. The stock has rallied 27.4% over the past year.

On October 5, Jay B. Stephens, the company’s Senior VP and Secretary, sold 10,000 shares at an average price of $55.66 per share. This follows a sale in September of as many as 200,000 shares at an average price of $57.83 a share by the company’s Chairman and CEO. Still, the stock is popular with billionaire Cliff Asness.

Illinois Tool Works (NYSE:ITW) is a $28-billion manufacturer of engineered products and equipment for the industrial, construction, electronics and other industries. It pays a dividend yield of 2.5% on a payout ratio of 31%. For comparison, its rivals Graco (NYSE:GGG), IDEX Corporation (NYSE:IEX), and Dover Corporation (NYSE:DOV) are yielding 1.9%, 1.9%, and 2.4%, respectively. Over the past five years, the company’s EPS and dividends grew at average annual rates of 8.2% and 10% per year, respectively. Analysts forecast that Illinois Tool Works’ EPS growth will average 11.1% per year for the next five years. The company is struggling with weakening international sales and, correspondingly, has reduced its full year outlook. Still, its internal restructuring, cost reductions, and share buybacks are expected to support EPS growth in 2013 despite weak sales projections. Illinois Tool Works has been raising dividends each year since 1964. The stock boasts a free cash flow yield of 4.5%, ROE of 18.8%, and ROIC of 17%. On a forward P/E basis, ITW is trading well below its respective industry and its own historical averages. The stock has rallied 23% over the past 12 months.

On October 24, the company’s Director, Robert McCormack, sold 128,500 shares at an average price of $60.27 per share. At the same time, the company’s Vice Chairman, David C. Parry, exercised options on 15,000 shares at a price of $35.12 per share and sold the stake at an average price of $60.40 per share. The stock is currently trading at $60.27 a share. Fund manager Ralph V. Whitworth (Relational Investors) owns as much as $770 million in this stock.

Yum! Brands Inc. (NYSE:YUM), $32-billion owner and operator of popular Taco Bell, KFC, and Pizza Hut restaurants, is paying a dividend yield of 1.9% on a payout ratio of 39%. Its main rival McDonald’s Corp. (NYSE:MCD) is yielding 3.5%. Over the past five years, the company’s EPS and dividends grew at average annual rates of 13.4% and 17.8%, respectively. Analysts forecast that its EPS will expand at an accelerated rate of 13% per year for the next five years. Yum! Brands is seeing especially strong growth in China and is seeing potential in expansion in emerging markets. The stock could be viewed as a pure play on the dining market in China, with a strong demand emanating from rising incomes and the burgeoning middle class. However, any notable slowdown in China’s economic growth would weigh on the company’s prospects and financial performance. Some traders are raising questions about Yum! Brands’ growth projections, following poor guidance from Chipotle Mexican Grill (NYSE:CMG), which is shorted by prominent hedge fund activist, David Einhorn. Yum! Brands has a high ROE of 77% and a ROIC of 31%. On a forward P/E basis, the stock is trading at a small premium to its respective industry. The stock has gained 28.5% over the past year.

On October 1, David Jonathan Blum, the company’s Senior VP and Chief of Public Affairs, exercised options on 9,500 shares at an average price of $29.61 per share and sold 2,992 shares at an average price of $67.20 a share. On October 11, Massimo Ferragamo, a company’s Director, exercised options on 4,624 shares at an average price of $10.82 a share and sold 1,900 shares at an average price of $71.34 a share. On October 11 and 15, Scott Bergen, Pizza Hut CEO, sold a total of 52,406 shares at an average price of $70.13 per share. On October 17, Roger Eaton, the company’s Chief Operations Officer, exercised options on 35,990 shares at an average price of $22.53 per share and sold the whole stake at an average price of $71.33 per share. The Yum! Brands’ stock is currently trading at $69.90 a share. Billionaires Steven Cohen and Stanley Druckenmiller (Duquesne Capital—check out its top holdings) have millions invested in the stock.