Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 20 stock picks easily bested the broader market, at 24.4% compared to 20.4%, despite there being a few duds in there like Berkshire Hathaway (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

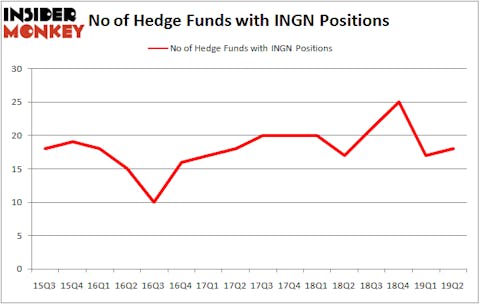

Is Inogen Inc (NASDAQ:INGN) a bargain? Investors who are in the know are turning bullish. The number of long hedge fund positions went up by 1 recently. Our calculations also showed that INGN isn’t among the 30 most popular stocks among hedge funds (see the video below). INGN was in 18 hedge funds’ portfolios at the end of June. There were 17 hedge funds in our database with INGN holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are many tools investors have at their disposal to analyze stocks. A pair of the most underrated tools are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the elite fund managers can trounce the broader indices by a very impressive margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a peek at the fresh hedge fund action regarding Inogen Inc (NASDAQ:INGN).

What does smart money think about Inogen Inc (NASDAQ:INGN)?

At the end of the second quarter, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in INGN over the last 16 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

The largest stake in Inogen Inc (NASDAQ:INGN) was held by AQR Capital Management, which reported holding $58.7 million worth of stock at the end of March. It was followed by Two Sigma Advisors with a $22 million position. Other investors bullish on the company included Renaissance Technologies, Balyasny Asset Management, and Partner Fund Management.

Now, specific money managers were leading the bulls’ herd. Balyasny Asset Management, managed by Dmitry Balyasny, created the largest position in Inogen Inc (NASDAQ:INGN). Balyasny Asset Management had $15.1 million invested in the company at the end of the quarter. Christopher James’s Partner Fund Management also initiated a $9.4 million position during the quarter. The following funds were also among the new INGN investors: Brandon Haley’s Holocene Advisors, Matthew Hulsizer’s PEAK6 Capital Management, and Efrem Kamen’s Pura Vida Investments.

Let’s now review hedge fund activity in other stocks similar to Inogen Inc (NASDAQ:INGN). These stocks are BMC Stock Holdings, Inc. (NASDAQ:BMCH), Callon Petroleum Company (NYSE:CPE), Blucora Inc (NASDAQ:BCOR), and G-III Apparel Group, Ltd. (NASDAQ:GIII). This group of stocks’ market caps match INGN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BMCH | 25 | 243038 | -4 |

| CPE | 12 | 166161 | -11 |

| BCOR | 16 | 127514 | 4 |

| GIII | 13 | 74478 | -5 |

| Average | 16.5 | 152798 | -4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $153 million. That figure was $150 million in INGN’s case. BMC Stock Holdings, Inc. (NASDAQ:BMCH) is the most popular stock in this table. On the other hand Callon Petroleum Company (NYSE:CPE) is the least popular one with only 12 bullish hedge fund positions. Inogen Inc (NASDAQ:INGN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately INGN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on INGN were disappointed as the stock returned -28.2% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.