This stock has been on a tear. After putting on a massive 61% last year, it still has the spring on its feet alive. Manitowoc Company, Inc. (NYSE:MTW) has already gained 17% this year. The crane maker’s stock outperformed most peers in the past twelve months, including bellwether Caterpillar Inc. (NYSE:CAT) by a gaping margin.

26*70 is a scary number

A company sells a small chunk of its business (one which not many knew even existed) and decides to use the proceeds to dump some of its debt. Sounds good, eh? Not when you know that the ’proceeds’ are as good as one hair on a full head. That’s the case with Manitowoc, which plans to put $26 million generated from the recent sale of its warewashing business to knock off a debt. Well, Manitowoc shoulders over $1.8 billion of debt.

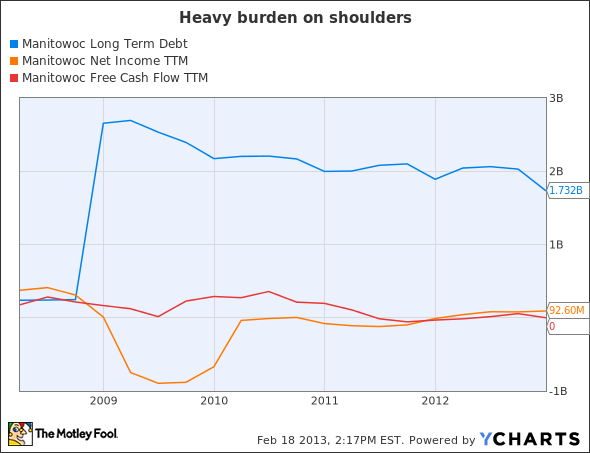

MTW Long Term Debt data by YCharts

Huge debt isn’t a new problem for Manitowoc. It existed ever since Manitowoc let out a victorious cry in 2008 when it edged out Illinois Tool Works Inc. (NYSE:ITW) to take over equipment-maker Enodis in a $2.7 billion deal. It was a risky bet for a business unrelated to Manitowoc’s core expertise, and it came at a heavy cost, the price of which the company is still paying. Manitowoc’s history is replete with instances of it selling off bits and pieces of its business only to generate some funds to pay down debt. The story remains, and Manitowoc has just left most wondering whether the hefty bet for Enodis was a wise one.

More than four years down the line, humongous debt continues to weigh it down, and the foodservice-equipment business has failed to show the growth desired. I dug deep into Manitowoc’s financials for the past few years, which threw up these woeful numbers.

| Food-service equipment business | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|

| Net sales | 1454.6 | 1487.3 | 1393.1 | 1334.8 |

| Earnings from operations | 241 | 216 | 203 | 167 |

Figures in millions.

Since the Enodis acquisition, Manitowoc’s foodservice-equipment business is yet to register double-digit growth on top line. Last year was the best in terms of earnings growth, but it rode on declining sales, which means cost-cutting worked behind the scenes. So that can’t really be termed growth. 2013 won’t be exciting either with the company expecting ‘mid-single digit’ revenue growth for the business.

Manitowoc’s free cash flow is measly for its debt at around $44 million with net income just about double of that. Cash flows and profits have hardly grown over the past four years (as you can see in the graph above), making it tougher for the company to balance growth while strengthening its financials. Don’t expect a clean balance sheet so soon – Manitowoc aims to shave off just around $200 million of debt this year.

Doesn’t stack well

So while Manitowoc reels under pressure, Illinois Tool Works’ margins have edged up over the years. In fact, Terex Corporation (NYSE:TEX) is the only company Manitowoc manages to beat in its game. Others trump it easily, and there’s reason.

MTW Net Income TTM data by YCharts