Jonathan Block: Okay. Sorry about that. And then let me just maybe try to throw a bunch of small ones in the second question. Brian, you talked about the vet visit data embedded at the midpoint. I’ve just gotten some questions. Is it as simple as extrapolating out the negative 1.5, call it, for the lower end, just when we think about your guidance? And then you still have this other box coming. I think that’s really what can really separate almost a staff from the visit data as people are getting more excited about the premium, right? So just taking a step back, do we think about you guys like handling it in a similar manner? Just if I recall last year, I think it was grade out in the investor presentation in August, officially introduced at VMX in January and then hitting the market 9 or 10 months after that in 4Q ’24 maybe just at a high level, if you can just talk about from a timing perspective when we think about that second still TBD box that you’ve alluded to in the past?

Thanks, guys.

Brian McKeon: Jon, can I just clarify your first question? I just wanted to follow what you were trying to get at when you said the — was it a full year question you’re asking? Yes, just trying to clarify what —

Jonathan Block: Yes. Sorry, Brian. Is it just as simple as I think maybe hopefully I have this right, but the midpoint of your guide has visits down 1.5 in 2Q and then essentially flat in 2H. Is it as simple for the lower end, call it, just take that 1.5 and like extrapolate it out for 2H? And that’s sort of what’s call it embedded in the lower band of your CAG DX recurring. That’s where I was sort of going with the first part.

Brian McKeon: It’s obviously a broader set of considerations, but I think directionally, your point is valid, which is if trends continue to be softer, that would be a factor that could be leading us towards the lower end.

Jonathan Block: And then on the new box?

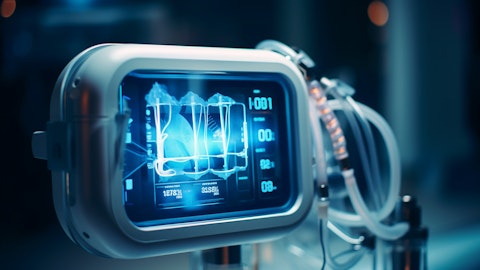

Brian McKeon: Look forward to sharing more as we get closer to launch, we’ll maintain the approach that we’ve used in the past that we’ll share that when we’re closer to commercial launch. We’re very excited about the inVue advancing and that’s on track. And as you know we’ll contribute directly, and we’ll have a lot of multiplier benefits to our business. And I know our sales force is very excited about that, and we are too. And we continue to advance our second platform. And we’ll share more on that over time, and we see that as also being an additive driver for our business over time.

Jonathan Block: Thank you.

Operator: We’ll go next to Navann Ty with BNP Paribas.

Navann Ty: Hi. Good morning. Thanks for taking my questions. A few follow-up on vet visits. If you could comment on the US vet industry progress on addressing shortages and mental health of vets and using more vet technicians to assist vets. Has this continued? And can you discuss any progress to date? And another follow-up on the macro headwinds on the pet owner side. What are your assumptions for the full year vet visits, wellness and non-wellness please? Thank you.

Jay Mazelsky: Yes. From an industry and profession side, the — what customers tell us and what we see is that the staffing churn has largely stabilized. Coming out of the pandemic, I think there was a lot of challenges and the veterinarian pet owners responded by, I think, increasing salary and benefits and cutting back some hours. So those impacts, I think, have largely stabilized. I think practices to the extent that they were able to hire more, have hired more. In some cases, they’ve instituted training, more internal training programs and have taken those sort of steps. They’ve also, as I mentioned earlier, invested more in technology. I think they’re just far more receptive around technology, software, equipment, use of our reference labs that helps them save time. Sometimes it may be 10 minutes, 15 minutes per procedure, but on the other hand, cumulatively that matters that I think can be highly worthwhile.

Operator: We’ll go next to Ryan Daniels with William Blair.

Ryan Daniels: Yeah, guys. Thanks for taking the question. Maybe just one quick one in the interest of time. You’ve talked about the longer-term dynamics of higher diagnostic utilization as pets age through their life cycle. And I know you also have some data about kind of larger than normal pet population growth post the pandemic. So I’m curious if you could give us your thoughts on when we might start seeing the benefits of that flowing through in the industry in regards to diagnostic use. Thanks.

Jay Mazelsky: Good morning, Ryan. What we see is it really increases over time even with the young adult dogs. So there’s obviously a lot of visits, puppies and kittens. And then as they become the young adults cats and dogs that both health care services, there’s a very modest dip, but generally health care services and diagnostics as both an absolute dollar amount and proportion expands. And then there’s — it grows or accelerates even more quickly as they get into the adult and geriatric stage. So our focus has been able to — is really on accelerating that through all life stages, including young adults or things like wellness test and exams. But it does go up over time. It’s just not linear through the different stages.

Jay Mazelsky: Okay. And with that, we’ll now conclude the Q&A portion of the call. Thank you for all your questions and for participating this morning. I’ll finish today’s call by reiterating that IDEXX is committed to the significant multi-decade opportunity to increase the standard-of-care for companion animal health care to diagnostic utilization. IDEXX’s organic growth strategy is helping lead the development of our sector and we look forward to continued high execution against our growth initiatives supported by teams from across the organization. Our growth outlook for 2024 builds off decades of investments in business capabilities that we have made and reflects ongoing sector development and financial results aligned to our long-term framework. And now we’ll end the call. Thank you.

Operator: This does conclude today’s conference call. You may now disconnect.

Follow Idexx Laboratories Inc (NASDAQ:IDXX)

Follow Idexx Laboratories Inc (NASDAQ:IDXX)

Receive real-time insider trading and news alerts