Brian McKeon: Sure. To your point, we feel very good about the start that we had in terms of the profit performance and the gross margin performance. We sustained our outlook despite taking down the high end organic growth outlook. So I think that just reflects some of the underlying operational execution benefits that we’re getting and our confidence in ability to deliver solid operating margin gains this year. I think that there are some select dynamics we noted, instrument costs being lower in Q1. Some of that is sort of an outflow of the pandemic supply chain impacts that have been alleviating. So we saw a relatively more benefit in Q1 than we will expect to see over time, but through the year. But I think for the most part, we’re — the performance is reinforcing the outlook that we had this year for solid comparable operating margin gains and I think reinforces that we can deliver strong financial performance as we work through some of the near-term macro dynamics that we’ve been highlighting.

Nathan Rich: Great. Thanks very much.

Operator: We’ll go next to Michael Ryskin with Bank of America.

Michael Ryskin: Great. Thanks for taking the question guys. I want to get at the vet visit dynamic in the underlying macro, but I’ll try to ask it in a different way. If we take a step back, this really started in 2022, and it was initially seen as a temporary effect of comps and working through that. We’re now almost 2.5 years into this and it continues to sort of lag behind expectations. We’re still waiting for this recovery in the vet visits. If this — if current trends persist, I hear what you’re guiding to for second half, and I hear what you’re talking about in terms of the improvement, but let’s say, trends persist and we still continue to see declines. Can you talk about other levers you could pull to sort of continue to hit numbers?

In prior years, for example, you took price and you took a second price increase once. I know you’ve got the inVue coming you’ve got operating leverage. So just talk us through sort of how you would think if this is remain under pressure, how you would address that? Thanks.

Jay Mazelsky: Yes. Good morning. I would point to a couple of things. One is, as you highlighted, our innovation agenda, the innovation portfolio we have, I think, is very strong. It consists really across the portfolio. From a point-of-care standpoint, obviously, we plan to begin shipping inVue in Q4. We think that, that has both a direct and indirect leverage impact on the overall business. I think our menu offering for the Reference Lab has never been stronger and growing. We expanded fecal antigen. We know that, that’s an important preventive care screening test that really sort of builds out the overall menu, Cystatin B, which is acute kidney injury and our overall — supporting our overall renal franchise menu has been very well received in the overall sector.

And then software, which has the twofer of not only being a great individual vertical business, but also the leverage and impact — positive impact, it has on diagnostics as a whole. I think our commercial execution continues to really be at a very high level. We see some benefits internationally where quarter-on-quarter-on-quarter, we’ve really seen some nice growth. I think that the investments we’ve made have been paying off an individual country and regions. So we saw nice performance in EMEA for example. And I think it’s just continuing to support our customers as they work through the dynamics we’ve highlighted. And we have confidence in the really in the attractiveness of the underlying demand that pet owners are generating and what the practices are doing around retaining staff and training them and seeking productivity and that we think over time those trends, those clinical visit trends will improve.

Brian McKeon: And Mike, I’d just reinforce, I think we’ve consistently demonstrated the ability to grow, continue to grow solidly and deliver strong financial performance. And so even as we work through kind of the growth off of the higher base that was established post the pandemic and through some of the more recent kind of macro dynamics that we’ve been highlighting. I think we’re continuing to find a way to advance our growth agenda to invest behind those things that are important while continuing to deliver strong financial results. So we remain committed to that and we would build a strong track record to support that outlook.

Michael Ryskin: Okay. But would you consider taking another price increase again or potentially some cost controls in the second half? Is that on the table?

Brian McKeon: I think we’ve laid out our outlook for this year and our assumptions to reinforce, we expect approximately 5% price improvement this year and that supports the operating margin outlook that we shared today and the strong comparable EPS growth as we invest in advancing our R&D agenda. We highlighted we’re investing more there and we’re excited about what’s going to come. So we’re confident in our financial outlook that we shared today.

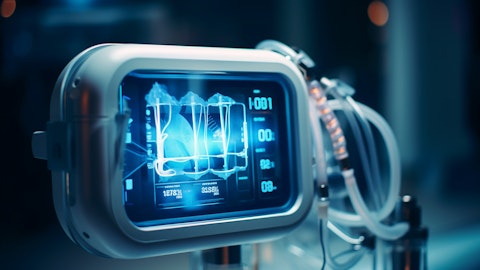

Michael Ryskin: Okay. And then just really quick one, if I could squeeze in a follow-up. Jay, I think you said in your prepared remarks that the inVue continues to — inVue remains on track. You talked about it at VMX, obviously. What’s been some of that early feedback from vets. I realize you’re still maybe five, six months from actually releasing it. But you’re three months further along than when you first sort of unveiled it. Any learnings in terms of the capabilities ramp? You know I talked about some of the offering that will be available to launch versus later on sort of what’s been the reception to that?

Jay Mazelsky: Yes. They’ve been — customers, in general, have been very enthusiastic and about the product itself. They like the fact that it addresses very high-volume, time-consuming clinical use cases within the practice ear cytology and blood morphology. One of the things that customers continue to tell us is they know they should be doing more blood morphologies that they’re doing just as part of a complete CBC or hematology work up. And now they feel like they’re going to be able to do it because it just makes a lot of sense. And so they’re looking forward to it. And we think the awareness level is increasing and that they see this as a really a worthy extension of our overall point-of-care VetLab suite. We’re also just, I would just remind folks that as part of the overall suite, we have a next generation of our VetLab Station, the IVLS station that provides workflow optimization and benefits and we’ve shown that to customers too, and they’re very enthusiastic about that as a whole.