Insider Monkey finished processing more than 700 13F filings made by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30th. What do these smart investors think about ICF International Inc (NASDAQ:ICFI)?

Is ICF International Inc (NASDAQ:ICFI) going to take off soon? Prominent investors are in an optimistic mood. The number of long hedge fund bets moved up by 4 recently. Our calculations also showed that ICFI isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most market participants, hedge funds are seen as slow, old financial vehicles of yesteryear. While there are over 8,000 funds with their doors open today, Our researchers look at the leaders of this group, approximately 700 funds. These money managers handle the lion’s share of the hedge fund industry’s total capital, and by paying attention to their highest performing stock picks, Insider Monkey has spotted numerous investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Cliff Asness of AQR Capital Management

We’re going to take a gander at the recent hedge fund action regarding ICF International Inc (NASDAQ:ICFI).

How are hedge funds trading ICF International Inc (NASDAQ:ICFI)?

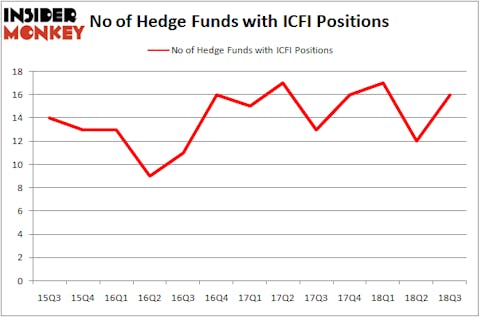

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 33% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ICFI over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, GLG Partners, managed by Noam Gottesman, holds the number one position in ICF International Inc (NASDAQ:ICFI). GLG Partners has a $13.1 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Sitting at the No. 2 spot is AQR Capital Management, managed by Cliff Asness, which holds a $11.4 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other peers with similar optimism encompass Martin Whitman’s Third Avenue Management, D. E. Shaw’s D E Shaw and Jim Simons’s Renaissance Technologies.

As one would reasonably expect, some big names were leading the bulls’ herd. PEAK6 Capital Management, managed by Matthew Hulsizer, established the biggest position in ICF International Inc (NASDAQ:ICFI). PEAK6 Capital Management had $0.8 million invested in the company at the end of the quarter. Mike Vranos’s Ellington also made a $0.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Alec Litowitz and Ross Laser’s Magnetar Capital and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as ICF International Inc (NASDAQ:ICFI) but similarly valued. These stocks are NGL Energy Partners LP (NYSE:NGL), Summit Hotel Properties Inc (NYSE:INN), Abercrombie & Fitch Co. (NYSE:ANF), and AxoGen, Inc. (NASDAQ:AXGN). This group of stocks’ market caps resemble ICFI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NGL | 5 | 9108 | -1 |

| INN | 12 | 22584 | 2 |

| ANF | 20 | 168236 | 0 |

| AXGN | 21 | 170982 | -1 |

| Average | 14.5 | 92728 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.5 hedge funds with bullish positions and the average amount invested in these stocks was $93 million. That figure was $52 million in ICFI’s case. AxoGen, Inc. (NASDAQ:AXGN) is the most popular stock in this table. On the other hand NGL Energy Partners LP (NYSE:NGL) is the least popular one with only 5 bullish hedge fund positions. ICF International Inc (NASDAQ:ICFI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AXGN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.