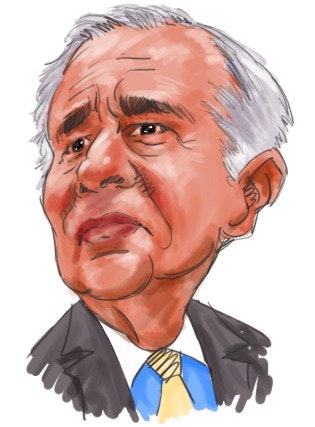

Just when you thought the war between Bill Ackman of Pershing Square and Carl Icahn of Icahn Capital had been settled and the soldiers sent home to tend to their crops, a shot across the demilitarized zone by Ackman has reignited tensions. We reported earlier today on a Wall Street Journal story which claimed that Icahn was reportedly looking to sell some of his Herbalife Ltd. (NYSE:HLF) stake, using investment bank Jefferies Group to seek buyers over the past month, which supposedly included a group that Ackman was involved with.

In an interview on CNBC later today, Ackman verified that he was contacted by Jefferies Group around August 4 or 5 about buying some of Icahn’s 18.32% stake in Herbalife, which he initially rebuffed. However, Ackman said that he later considered buying a few million shares as part of a consortium of buyers, though he claims he would’ve sold the shares the next day. According to Ackman, he would’ve bought the shares for the purpose of hastening Icahn’s departure from the stock, which he believes is providing it with a level of security.

“This is a confidence game. Carl is what creates the confidence in the company. If Carl sells, it can accelerate the demise of the company,” Ackman said. “With Carl exiting, I think the thing is over, and over quickly. The sooner he sells the better.” Ackman later stated that he believes that Icahn thinks that Herbalife Ltd. (NYSE:HLF) “is toast” and wants to get out before the shares go down.

Shares of Herbalife did indeed go down, falling by more than 2% during Ackman’s CNBC interview to more than 5% in the red at one point. However, it appears that Ackman’s dream of an Icahn exit and a tumbling Herbalife stock was nothing but that: a dream. In the filing below, released this afternoon, Icahn blasted Ackman’s comments, saying that he has an obsession with Herbalife that is blinding him to the facts and criticizing his nerve to go on television and purport to know what Icahn’s thoughts and intentions are. Icahn further stated that he has never given Jefferies Group an order to seek buyers for any of his Herbalife shares.

Just to rub salt into Ackman’s fresh wound, Icahn also bought slightly more than 2.3 million Herbalife shares today at $59.31 per share, increasing the average price of his position and bestowing a huge vote of confidence on Herbalife. “I continue to believe in Herbalife: it’s a great model that creates a great number of jobs for people,” Icahn said in his statement. Shares have jumped by 3.80% in the after-hours session, erasing the day’s losses. Icahn now owns 19.30 million Herbalife shares, lifting his ownership stake in the company to 20.78%.

It seems rather unlikely that Ackman fabricated the story about being contacted by Jefferies Group, as there would be no long-term benefit to doing so, but we’ll have to wait and see what Ackman has to say in his defense. What we do know as the dust settles from the latest clash between the two investing titans is that this battle was a clear win for Mr. Icahn.

Follow Herbalife Ltd. (NYSE:HLF)

Follow Herbalife Ltd. (NYSE:HLF)

Receive real-time insider trading and news alerts

You can access the original SEC filing by clicking here.

Ownership Summary Table

| Name | Sole Voting Power | Shared Voting Power | Sole Dispositive Power | Shared Dispositive Power | Aggregate Amount Owned Power | Percent of Class |

|---|---|---|---|---|---|---|

| High River Limited Partnership | 3,860,937 | 0 | 3,860,937 | 0 | 3,860,937 | 4.16% |

| Hopper Investments | 0 | 3,860,937 | 0 | 3,860,937 | 3,860,937 | 4.16% |

| Barberry Corp | 0 | 3,860,937 | 0 | 3,860,937 | 3,860,937 | 4.16% |

| Icahn Partners Master Fund | 6,274,424 | 0 | 6,274,424 | 0 | 6,274,424 | 6.75% |

| Icahn Offshore | 0 | 6,274,424 | 0 | 6,274,424 | 6,274,424 | 6.75% |

| Icahn Partners | 9,169,322 | 0 | 9,169,322 | 0 | 9,169,322 | 9.87% |

| Icahn Onshore | 0 | 9,169,322 | 0 | 9,169,322 | 9,169,322 | 9.87% |

| Icahn Capital | 0 | 15,443,746 | 0 | 15,443,746 | 15,443,746 | 16.62% |

| IPH GP | 0 | 15,443,746 | 0 | 15,443,746 | 15,443,746 | 16.62% |

| Icahn Enterprises Holdings | 0 | 15,443,746 | 0 | 15,443,746 | 15,443,746 | 16.62% |

| Icahn Enterprises G.P. Inc | 0 | 15,443,746 | 0 | 15,443,746 | 15,443,746 | 16.62% |

| Beckton Corp | 0 | 15,443,746 | 0 | 15,443,746 | 15,443,746 | 16.62% |

| Carl C. Icahn | 0 | 19,304,683 | 0 | 19,304,683 | 19,304,683 | 20.78% |

| Date of Transaction Amount of Securities Price Per Share High River Limited Partnership |