Rajiv Prasad: 3,000 to 500,000.

Alfred Rankin: So really is to look at the single numbers in the backlog in terms of units is probably not as helpful as understanding and focusing on the revenues. That’s something we’ve got to think about as well as you all and we are.

Ted Jackson: So I’m taking that those answers then and the dialogue with and commentary with regards to guidance, that sounds to me like the production issues, which are related to the bigger trucks really will be resolved as we get out of the second quarter and you deliver those, we should see —

Alfred Rankin: Again, I just want to be careful about the use issues?

Ted Jackson: It’s okay.

Alfred Rankin: These trucks have to be produced. They’re very good trucks and we want to produce them. And we want to take the time that it takes to make them. Rajiv used the right word. There’s less throughput in terms of units, but the dollars throughput is pretty darn good.

Ted Jackson: Okay. I understand. I’m just trying to get but let me get to my question because my question is really — it’s not about terminology, it’s — and tying into that is, as you deliver that backlog that we will see, our gross margin in the lift truck business comparable to the first quarter in the second quarter. And then because the mix of your production changes, the unit volume will go up. The ASP will go down, and we will see, for lack of a better term, a contraction in gross margin in the second half. That’s where I am going. Just the cadence of how your backlog is going to be going through your financial statements and how I see it, that’s what I am asking. masking?

Rajiv Prasad: Yes. I think the way that we’re thinking about it right now is we think the second quarter is going to be like the first quarter. The second half, we’re still doing a lot of work to figure out how exactly to execute the second quarter because —

Alfred Rankin: They’re actually the second half.

Rajiv Prasad: Second half, sorry. on it. And part of it is our customers are concerned about getting some of these trucks. So I’ll just give you a — for instance, for the second half, we’re considering and we’re exploring, getting EMEA to build some of the trucks for North America because they have caught up in a much better way — their lead times now are lower than the Americas. So we feel they could build some trucks for Americas. So that’s where the second half is still something that we’re in the middle of planning on. So it’s really difficult to comment on that on.

Alfred Rankin: I think another way to think about it is, just the backlog, which is — really takes us largely through the year.

Scott Minder: Yeah.

Alfred Rankin: Has pretty darn good margins. We did fall out the negative, which, of course is the likelihood as we see it now that the tariff exclusions will not be kept up. That will be a headwind for us in the second half. And so it’s more of those kinds of things.

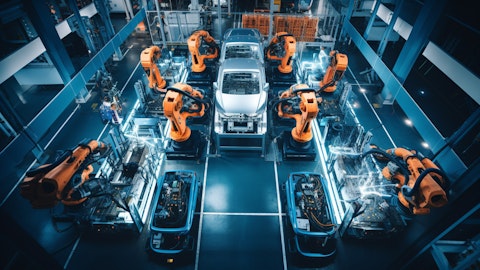

Scott Minder: And I guess the other headwind we’re going to go down is this the shipment costs, logistic costs because of the Red Sea issues. So we’ve had — it’s a longer trip, more expensive trip for our material and trucks coming out of Asia to our plants. So those two are headwinds, and we’re trying to figure out what is the right way to and where to build some of the trucks as well. So I know it there’s a fair bit of complexity. And we’re trying to manage that ourselves. Trying to figure out the best way to get through this situation we find ourselves in. So we are getting increasingly more pressure from customers to get these trucks, which are really production oriented trucks. They’re really core part. You think about automotive, think about paper industry, steel industry, these trucks aren’t support trucks, they’re integral part of the production system.

Ted Jackson: Yeah, and t’s good case, I know. I’m going to beat the unit thing one more time. And then I’ve got another question behind that. And so when I think about the last call, there was, for lack of a better term, a shortfall in terms of deliveries. And they got delivered in the first quarter. And honestly, I was expecting to see growth in units at least on a sequential basis, and I did not. And so I want to go into units, and why I want to is because if we’re going to see units grow in fiscal ’24 relative to fiscal ’23, given where you’ve started the first quarter, will we see meaningful unit growth in the second quarter because I’m trying to understand again kind of the cadence of this as we roll through the fiscal year? So that’s where I’m going with it. Just how do I think about second quarter, and then I do actually have a much more fun question after this stuff.

Rajiv Prasad: Okay. So the way I would think about it is second quarter is going to be similar to first and then the second half, I think we’ll do better on the build rate.

Ted Jackson: Okay. That was actually easy. Okay, now, here’s my more fun question for you. You’re ready. So you commented in the press release and in your presentation about the success you had in the EMA with warehouse truck orders. I know from your Investor Day that you have highlighted the warehouse market as an important opportunity for longer-term growth because your underrepresented market share in that vertical. So when I hear that, my question is, is the success that you had in the first quarter of ’24, an early indication of the success in taking market share in that segment? And what will the stat success as you progress through it mean to your margin structure over time?

Rajiv Prasad: And so let’s just think about share as two components, it’s participation, and close rates. And so where we are very, very focused right now, Ted, is increasing our participation. And there’s huge amount of work going on in every region for us to increase our participation in warehouse in a very significant way. Now, some engagements that can turn into orders fairly quickly. And that’s been the case with a couple of major account customers in EMEA. With others, it takes — it’s a longer lead time to turn those into — to get the close and turned those into orders. But I will just talk about our focus, it’s to increase participation. And as we start to participate, we’ll get a sense for what we need to do to improve our close rates as we start to get feedback from customers on our initial quotes. So that’s the way we’re kind of trying to serve the market. Does that make sense in terms of a process and come and how we’re going after it?