Hidden Value Stocks issue for the first quarter ended March 31, 2020, featuring Alta Fox Capital Management and their stock idea, Pollard Banknote Ltd (TSE:PBL) (OTCMKTS:PBKOF).

Alta Fox: Introduction

Alta Fox Capital Management is a Fort Worth, Texas-based investment manager that primarily focuses on identifying under the radar, high-quality businesses with competitive advantages at cheap multiples of mediumterm (three to five years) earnings power. Last year, the firm was able to take advantage of the market volatility to buy companies conforming to this framework.

Alta Fox’s desire to find undiscovered, highquality businesses typically leads them to the small-cap space where there is less competition, although that’s not always the case.

Two of the fund’s best-performing investments in 2020 were multi-billion dollar companies. Connor Haley, Alta Fox’s managing partner, attributes some of the fund’s success to studying previous market winners. Over the years, Connor has spent a great deal of time studying great businesses and stock market outliers. This past summer, Alta Fox published a 645-page internal case study titled “The Makings of a Multibagger.”

Key Takeaways

The research generated five high-level takeaways:

- Look for businesses with advantageous positioning: 80% of businesses had moderate-to-high barriers to entry and 91% had moderate-to-high competitive advantages.

- Spend time on financially healthy companies: 88% of outperformers came from a position of financial health in June 2015 and grew faster than the market might have anticipated. Looking for financially healthy companies, rather than turnarounds, is also less risky.

- Acquisitions can create value: While many acquisitions fail to create value, the highest performing stocks often leverage acquisitions to bolster their returns. If you are looking for phenomenal returns, finding companies that make strong acquisitions will increase your odds of success.

- Don’t rely on multiples: While it is always better to buy a great business at a low multiple rather than a high one, many of the top-performing stocks began with already healthy multiples – those multiples often expanded even further.

- Be open to international companies: Many of the best performing were American (32%); however, the USA was underrepresented in the set, meaning it is less likely that a company in America would achieve > 350% returns compared to some other countries such as Sweden, Australia, and Germany.

Investment In Collectors Universe

One of Alta Fox’s best performing investments last year was Collectors Universe (NASDAQ:CLCT). In the firm’s Q4 2020 investor letter, Connor Haley explains that the firm had to play the role of a “reluctant activist” with the company. Still, it ultimately ended up producing sizable profit for Alta Fox and its SPV. As per the Q4 2020 letter:

“We began building our position in March of 2020 and bought most of our shares in the low to mid $20’s. Alta Fox first filed a 13D in June and settled with the company in September. The company then received a tender offer in November at $75.25. Alta Fox publicly filed for appraisal rights in December. The offer was recently revised at $92.00/share. Today we updated our 13D filing, as required by the SEC, to confirm our demand for appraisal rights at the updated offer price. We have conducted a tremendous amount of research on this investment and we are in no rush to relinquish our significant stake given the surging demand, a growing backlog, and numerous attractive reinvestment opportunities.”

Although the Collector’s Universe opportunity required Alta Fox to launch an activist campaign to call attention to unrealized value, the firm much prefers to work amicably with talented management teams.

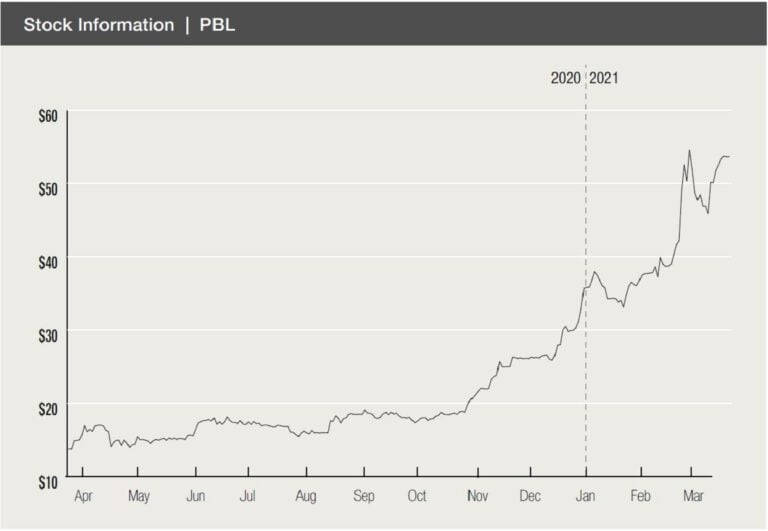

The firm’s latest high-conviction idea posted on March 24, 2021 has already caught the market’s attention. Alta Fox believes that Pollard Banknote’s business is about to experience a significant inflection in profitability and that its equity is still meaningfully undervalued by the market today. The company’s share price increase following Alta Fox’s post indicates that investors agree with the detailed research supporting their thesis.

Stock Idea One: Pollard Banknote Ltd (PBL)

To start, could you provide a summary of Pollard Banknote’s business and outlook?

Pollard Banknote Ltd (TSE:PBL) (OTCMKTS:PBKOF) is a high quality and secularly growing business. It is underappreciated by the market due to sporadic disclosure surrounding its iLottery (online lottery ticket sales) segment. PBL is one of 3 developers & manufacturers of physical instant/scratch tickets in North America (competitors being IGT and SGMS). This business has compounded revenues since 2012 at a CAGR of 9%. PBL also owns 50% of the most successful iLottery business in the U.S., NeoPollard Interactive (NPI), which provides the technology and games to enable selling lottery tickets online and is currently growing revenues triple digits. PBL’s outlook is bright as we believe high levels of growth for both segments and continued overall margin expansion will prove sustainable.

Focusing just on its main division of scratch ticket manufacturing — is the firm exposed to any regulatory issues?

PBL must maintain compliance with government regulations to keep its licenses which allow it to do business with state lotteries. Additionally, state lotteries are inherently risk adverse leading them to prefer to do business with established, credible U.S. vendors. Put simply, becoming legally compliant and building out relationships with state lotteries (in addition to procuring the necessary manufacturing capacity) is so difficult and cost prohibitive that the industry has remained roughly unchanged for the better part of the last 2 decades (with SMGS, PBL, and IGT supplying all the instant lottery tickets). Lastly, domestic manufacturers benefit from the U.S. government’s ban on imports of lottery tickets from outside North America into the country. Understanding these regulatory nuances is key to understanding the high barriers to entry in the lottery supplier oligopoly.

How has this business division performed over the past five to ten years? What opportunities and threats has it encountered?

PBL does not currently separate retail lottery sales from iLottery sales. We, therefore, estimate that its retail instant ticket sales division has grown at a CAGR of 10% from FY15 to FY20. While the business and industry have been remarkably stable over the last decade (with global lottery sales up during the 2007-2010 period), the biggest threat to the business, the introduction of iLottery, has become its greatest opportunity. iLottery instants are fundamentally different from retail scratch tickets. Online games are more fast paced, have higher payout ratios with higher frequencies, but tend to attract a different player base since the look and feel of these games is closer to online slot machines than to scratch-off tickets.

The company’s integration of wallets/accounts for online and offline play, as well as giving online players offline bonuses, has helped drive new foot-traffic to purchase instant tickets at retail.

Has the pandemic impacted its overall business (if so, how?), and do you expect this to last?

While the pandemic has been a mild headwind for PBL’s retail business (we estimate 1% growth in total for the retail business in 2020), it has significantly accelerated the growth of PBL’s iLottery business, sending revenues up over triple digits.

Despite iLottery penetration more than doubling in many states during 2020, iLottery still remains at <1/3rd of total state wagers in each state where it is legalized (this compares to countries in Europe like Norway and Finland where penetration today is closer to 45- 50% of total lottery wagers). We believe high growth in iLottery sales is very sustainable over the next decade as U.S. states that have already legalized iLottery see penetration levels approach (if not significantly surpass) comparable European penetration levels.

Additionally, industry experts believe that the pandemic has served as a catalyst for new states to speed up their timelines for rollouts of iLottery platforms. We think NPI is well positioned to win 40-50% of all new iLottery RFPs in the coming years.

PBL’s Valuation

What valuation do you put on this division based on these projections?

We believe that PBL’s core manufacturing business has been perennially undervalued by the market and that the market has historically ascribed no value to the highly competent management team at its helm. Combined with the acceleration in physical lottery sales following the introduction of iLottery, we believe the business should trade at a significant premium to its long-term average. We value PBL’s retail business at 15x EBITDA, in-line with the higher-end of Lottery industry comparables such as FDJ (publicly traded lottery operator in France).

Moving onto the NeoPollard joint venture. In your report, you note that the market seems to be significantly undervaluing this joint venture. What does this joint venture do, and where is the value to Pollard?

NPI provides all the technology infrastructure and games necessary for a state to have its own iLottery program. NPI also provides ongoing support and optimization efforts to make iLottery offerings as engaging and successful as possible. NPI is highly incentivized to continue to add value to lotteries following the initial platform deployment since NPI is paid as a % of revenues. This leads to a highly scalable business model, evidenced by NPI’s 55% EBIT margins and 69% incremental EBIT margins in 2020 in Michigan.

While PBL has not broken out the complete revenue or earnings power from this segment anywhere in its financial segments, Neogames (NGMS), the other 50% owner of NPI, gave investors all the missing details in its prospectus filed in late October 2020. In our research report, we show our best attempt at reconciling PBL’s financials with NGMS’ reported NPI numbers, backing into segments for PBL’s retail business and iLottery business. As more investors perform this segment analysis and value each segment appropriately, we believe others are likely to agree with our conclusion that PBL is significantly undervalued.

With Neo, “Over the next 10 years, we estimate iLottery revenues for NPI can compound at >20% per year and that the business will achieve EBITDA margins in the low 60%s by 2030.” Can you talk a bit about how you reached that figure?

We believe NPI is still in the early days of iLottery penetration both in the context of their existing customers and within the context of the broader lottery industry. As NPI’s current customers (states) see iLottery penetration levels improve and as NPI wins new RFPs, we believe revenue will ultimately show a CAGR of >20% over the next decade. Moreover, in comparatively “mature” iLottery states like Michigan, EBIT margins are already 55% with incremental margins as high as 69%. We think it is very reasonable that the entire iLottery business will be earning EBITDA margins north of 60% in 10 years given Michigan’s profitability levels today.

The Value Of The Joint Venture

Based on these projections, how much is the value of the joint venture worth to Pollard?

Looking out to 2024, we estimate that PBL’s 50% stake in NPI is worth more than PBL’s entire market cap today (~1.5B CAD).

You’ve noted that one of the reasons why the market is undervaluing Pollard is the inability to value the Neo Joint venture correctly. Why do you think this will change going forward?

Given that Neogames has publicly revealed the earnings power of NPI in its prospectus documents, we believe it is likely that PBL will start to break out its iLottery segment in the coming quarters which will allow investors and sell side analysts to value PBL more easily and accurately.

If this doesn’t happen, how will this impact your analysis of the business?

Even if PBL chooses not to disclose iLottery revenue and earnings separately, NGMS is highly likely to continue reporting on NPI revenue and earnings separately, allowing investors to continue to back into NPI’s contribution to PBL’s earnings power. Even in this scenario, it is likely that sell side analysts eventually value PBL through a similar SOTP segment analysis.

The Pollard family owns 65% of the stock. How has the family ownership benefitted Pollard and its investors? How do you rate management? Has management created value for investors?

It is hard to ask for a more aligned management team. The Pollard family has been an exceptional steward of shareholder capital, compounding shareholder value at 37% annualized since April 2015 when IGT relisted in the US, significantly outperforming all major lottery peers. Being family controlled has allowed Pollard to move decisively when needed while maintaining a long-term perspective. Management’s best qualities have been exemplified in moving forward with NPI in 2014 and almost immediately winning Michigan’s iLottery contract, making many accretive tuck-in acquisitions over the last decade, and in PBL’s recent purchase of NGL in December 2020. Management’s efficient capital allocation and growth strategies have been instrumental in the businesses’ success over the last decade.

Sum Of The Parts Valuation

Considering all of the above, what’s your Sum of the Parts valuation for the company?

At 15x EBITDA for PBL’s retail business and 21x EBITDA for PBL’s stake in NPI (a 20% discount to NGMS’ NTM EBITDA multiple), we estimate that PBL will be worth 87 CAD by FY23, yielding >100% upside from the time our report was published. That said, we think that there are multiples of upside in PBL over the next decade as iLottery earnings power grows rapidly and the segment multiple expands.

What are the main risks to your thesis?

The #1 risk that savvy investors are focused on is the sustainability of the NPI JV. Either party could walk away and attempt to compete for iLottery contracts under its own bid instead of under NPI. We think it would be foolish for both PBL and NGMS if either party were to walk away from the JV and that their chances of winning incremental future contracts would decrease significantly (NGMS is a foreign entity with very limited roots in the US, while PBL’s iLottery technology remains unproven in the US). There is a significant amount of white space left to capture in the industry and NPI is best positioned to win.

Suggested Articles: