We recently compiled a list of the 7 Best Copper Stocks to Buy According to Analysts. In this article, we are going to take a look at where Hudbay Minerals Inc. (NYSE:HBM) stands against the other copper stocks.

Copper is one of the most important metals in the world. Without it, the global industrial and electrical infrastructure will collapse since nearly every electrical system depends on the metal. Data from the Copper Development Association shows that an average single family home covering 2,100 square feet has 439 pounds of copper. More than half of this, or 346 pounds are for wiring and plumbing fittings. Similarly, an average air conditioner has 52 pounds of copper.

At the same time, while copper’s dominance in residential and industrial use cases is permanent and is unlikely to change, its demand should grow in the future due to today’s emerging technology trends. The biggest trend right now is artificial intelligence and systems such as OpenAI’s ChatGPT use as many as 10,000 GPUs for their training. These GPUs require power, and transporting power requires wires that use copper. According to Rob Thummel, senior portfolio manager at Tortoise Capital, the demand for electrical infrastructure is an overlooked aspect of the AI boom, since he believes that there “is no AI without EI (energy infrastructure) because you need this critical infrastructure to provide the fuel to keep their lights on and electricity flowing 24 hours a day.” You can check out which stocks might benefit from the potential gold rush by reading 9 Best AI Energy Infrastructure Stocks to Buy Now.

Naturally, should this demand materialize, then global copper demand will naturally have to grow. However, since copper mining is a capital intensive activity, it takes time for the supply to catch up with demand due to the long development times for copper mines. This means that investors pile into copper stocks with the hope of catching the right picks before they take off, and as AI stocks have soared, copper has followed. Despite a global industrial slowdown led by China (one of the largest users of copper in the world) copper futures have gained 19% since ChatGPT was released. These gains come after an 8.8% drop in July after Chinese economic growth missed analyst estimates. Copper traded on the London Metal Exchange (LME) opened at $8,500 per ton in 2024, and its latest closing price is $9,213 to mark an 8% gain. Since the launch of ChatGPT, copper prices have gained roughly 12%.

So what’s driving global copper demand despite an industrial slowdown? Well, research from the commodity trader Trafigura shows that cumulatively, the growth in electric vehicles, electricity demand, and AI use cases will create an additional 10 million pounds of copper demand over the next decade. Each of these use cases will account for a third of this demand, and industry sources speaking to Reuters also add that copper supplies are tight these days. As of April 2024, copper stocks in LME registered warehouses dropped by a strong 35% since October 2023 to sit at 121,000 tons. This trend continued in June, with the latest data outlining that as of June 27th, headline LME copper stocks slid to 77,050 tons from 100,100 tons three weeks prior despite the fact that 30,000 additional tons were added. Global copper stock inventory sat at the lowest level since 2008, so it’s clear that the market is quite tight even as industrial activity in China and Europe is slow and America battles with high interest rates.

This crunch has come on the back of a broader industrial tightness as well as specific developments. Starting from the former, the S&P Global released a detailed report on the state of the copper industry in May. Its research outlines that copper in initial resources tanked by a stunning 42% in 2023 and sat at 7.6 million for a four-year low. This came on the back of reduced mining activity and lower budgets. The subsequent fall in copper prices due to lower industrial activity also led to a mere 2% growth in initial copper exploration budgets in 2023, which sat at $1.43 billion at year end.

As for the specific developments that have constrained copper supply, a major copper mine in Panama capable of producing 300,000 tons per annum was closed after a court order found that its contract violated the country’s constitution. The Cobre Panama mine accounted for 5% of the country’s GDP and 1% of global supply, and the ruling in November was followed by one of the biggest copper producers in the world cutting its 2024 production guidance. The miner shared that its 2024 production would range between 730,000-790,000 metric tons to mark a 20% cut from the previous estimate to account for disruptions in its facilities in Chile and Peru.

As copper capacity remains tight, global mining giants are already eyeing the future. They are now focusing on Argentina, where a new government is eager to invite foreign capital to stimulate the economy. While Argentina’s share in global copper production is negligible, estimates show that if just six mining projects come online then it could produce one million tons by 2035 and lead to $8 billion in exports. Copper miners have to fork out $130 billion over the next decade if they want to avoid a 7.7 million shortfall in 2034, and for their Argentinian plans, they’ll have to contend with a hostile population, geographic problems, and environmental constraints.

Before we get to the top copper stocks that analysts are optimistic about, fund L1 Capital shared quite a bit of relevant insights for the industry in its Q1 2024 investor letter. It pointed out that by 2027, new data centers could add as much as 1 million tons of additional copper demand per annum, and added that supply needs to grow by quite a bit:

Market supply has tightened into 2024 as existing mine production downgrades and suspensions flowed into the physical markets. The most notable event here was the Cobre Panama mine (~400kt p.a.), which was placed into suspension by the local authorities in November 2023. Other major producers such as Anglo American have also significantly reduced near-term production guidance (Figure 10). While these disruptions provide a catalyst for supply tightness, the industry is structurally challenged in the longer term by a declining existing asset base, as the geological characteristics (i.e. mine grades) deteriorate over time (Figure 11). Escondida, the world’s largest copper mine, has seen copper grades decline from ~3% in the 1990’s to ~0.5% today. This means to produce the same amount of copper, roughly six times the material is required to be mined than at the start of the mine’s life.

While supply growth has been robust over the last three years with numerous projects commissioned (10 projects, bringing ~2Mt of incremental supply), this is largely already factored into current supply estimates, as incremental new project growth slows from 2025. Going forward, BHP estimates the world may need incremental supply of ~10 Mtpa of copper by 2030 (7 Mt to meet growth and 3 Mt to offset projected decline at existing operations), while in 2023 only 340kt of new supply was sanctioned (Figure 12). BHP further estimates the capital requirement to achieve the 10Mtpa production is a staggering US$250b, of which a small amount has been committed today (Figure 13). For context, Sandfire is the largest listed ASX copper producer – the capital requirement to meet market demand represents ~100x their current market cap (i.e. the world needs 100 more Sandfires spent)

With these details in mind, let’s take a look at the best copper stocks to buy according to analysts.

Our Methodology

To make our list of the best copper stocks to buy according to analysts, we ranked all publicly traded companies on US exchanges engaged in copper mining by their average analyst percentage share price upside and picked out the top stocks.

We also mentioned the number of hedge funds that had bought these stocks during the same filing period. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

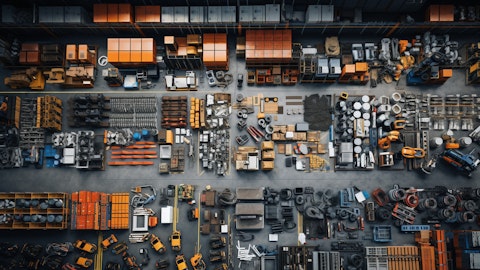

An aerial view of a copper mine, showing the intricate workings of heavy machinery.

Hudbay Minerals Inc. (NYSE:HBM)

Number of Hedge Fund Investors in Q1 2024: 31

Analyst Average Share Price Target: $12.13

Upside: 50.31%

Hudbay Minerals Inc. (NYSE:HBM) is a Canadian mining company that focuses on mining copper, zinc, and gold. It has a sizeable copper portfolio, which includes impressive names such as the Copper World project in the US which is one of the highest grade open pit mining projects in this part of the world. Phase 1 of this site has an expected life of twenty years, and it can produce 92,000 tons per year. Additionally, Hudbay Minerals Inc. (NYSE:HBM) also acquired Copper Mountain in 2023 to create what it terms the third largest copper producer in Canada. The deal added six new copper production sites to its portfolio and set Hudbay Minerals Inc. (NYSE:HBM) as a long term copper producer. The firm is also aided by the fact that it generates healthy cash flow by mining gold, which helps its cash position to finance the copper mining projects. Raising capital is key for Hudbay Minerals Inc. (NYSE:HBM)’s success, as phase one of Copper World will cost $950 million. The firm is interested in selling a minority stake in the site to interested parties to help offset some of the costs.

Hudbay Minerals Inc. (NYSE:HBM)’s management commented on the costs and future copper production during its Q1 2024 earnings call. Here is what they said

. . .Copper World is the next promising greenfield copper development project in our growth pipeline. As we progress towards making the sanctioning decision, we will continue to be prudent with our financing plans for Copper World by remaining focused on meeting all of the prerequisites outlined in our 3-P Plan that we introduced in late 2022. Copper World is one of the highest grade open pit copper projects in the Americas with proven and probable reserves of 385 million tonnes at 0.54% copper in Phase 1. There is roughly 60% of the total contained copper remaining in the measured and indicated resources excluding reserves, which provides significant upside potential for Phase 2 expansion and mine life extension beyond 20 year.

. . .We expect to launch the formal Joint Venture process later this year, after we secure our permits and prior to commencing a definitive feasibility study, which would allow the potential Joint Venture Partner to participate in the funding of definitive feasibility study activities as well as in the final project design for Copper World. We have seen strong initial interest from potential Joint Venture Partners, as many industry participants are focused on increasing copper exposure. Securing copper supply becomes a growing global concern, as evidenced by BHP’s recent bid by Anglo American in an effort to increase their copper exposure. Copper World will be a key contributor to the domestic US supply chain, with our intention to produce made-in-America copper cathode by building a concentrate leach processing facility in the fourth year of operations.

Overall HBM ranks 3rd on our list of the best copper stocks to buy. You can visit 7 Best Copper Stocks to Buy According to Analysts to see the other copper stocks that are on hedge funds’ radar. While we acknowledge the potential of HBM as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than HBM but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Analyst Sees a New $25 Billion “Opportunity” for NVIDIA and Jim Cramer is Recommending These 10 Stocks in June.

Disclosure: None. This article is originally published at Insider Monkey.