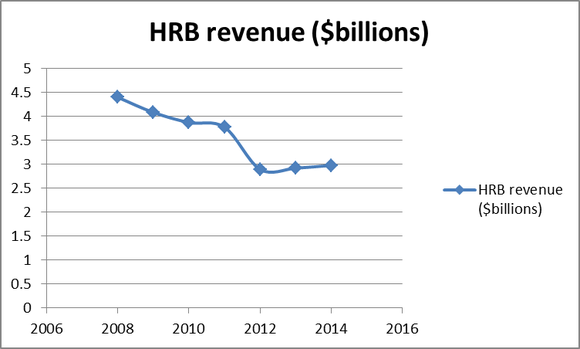

One of the most well-known tax preparation service providers in the United States, H&R Block, Inc. (NYSE:HRB) has struggled to produce revenues over the past several years. In fact, the company’s revenue has declined every year since 2008 as a result of increased competition and increased transition to online tax preparation by individuals. With all of the poor results the company has produced, why have shares nearly doubled in the past year? Am I missing something here?

**Note: 2012’s revenue reflects the sale of the company’s business services division.

About H&R Block

H&R Block, Inc. (NYSE:HRB) is one of the largest tax service providers in the world, with over 25 million clients in 2012. The company operates or franchises almost 11,000 tax preparation locations in the U.S., and more than 1,500 international locations, mostly in Australia and Canada. H&R Block, Inc. (NYSE:HRB) also offers online tax preparation and tax preparation software.

Outlook

After years of declining revenue, H&R Block, Inc. (NYSE:HRB) announced a restructuring program in April 2012, with a goal of $85 million- $100 million in annual cost savings by the end of 2013. The company is projected to earn $1.62 per share for fiscal year 2013, rising to $1.89 and $2.15 in 2014 and 2015, respectively, mostly as a result of cost savings related to restructuring. Revenues are not expected to rise significantly over the next several years, with a total of about a 3% increase expected over the next two years.

On the positive side, H&R Block, Inc. (NYSE:HRB) has two very nice things going for it: an excellent balance sheet and a strong dividend yield of 2.7%. The company has over $1.5 billion in net cash on its balance sheet, but don’t get too excited about this. Shares are still way too expensive at over 23 times earnings, which is very high, especially for a company whose revenue is yet to stabilize.

Better Ways to Play the Tax Service Sector

Despite the decent earnings growth projected for H&R Block over the next few years, there are better ways to play the sector. One of my favorites is Intuit Inc. (NASDAQ:INTU), which is the company behind TurboTax and QuickBooks, and another good choice is to play the sector indirectly, through stores that sell the things that people use to do their own taxes, such as Office Depot Inc (NYSE:ODP).

Intuit Inc. (NASDAQ:INTU) is the only other publicly traded company that is a true direct competitor to H&R Block. They are best known for their TurboTax, QuickBooks, and Quicken software programs. Just like H&R Block, Inc. (NYSE:HRB), Intuit Inc. (NASDAQ:INTU) is also cash-positive and is projected to grow its earnings nicely over the next several years, at a consensus of 12% annually. Unlike H&R Block, Intuit has an excellent track record of growing its revenues, as it has greatly benefitted from the same online and do-it-yourself tax return trends that have hurt H&R Block.

Office Depot Inc (NYSE:ODP) is a play on the retail side of do-it-yourself finance, which is being made easier for the average consumer with more advanced and user-friendly software programs, such as TurboTax. In addition to the software itself, Office Depot sells virtually every other item a consumer would need to facilitate doing his/her own taxes and finances. If you think that the trend toward do-it-yourself and internet finance will continue, Office Depot Inc (NYSE:ODP) may be a good way to play it, especially if you’re not sure exactly which manufacturers will benefit the most.

What to Do With H&R Block?

If you already own shares of H&R Block, Inc. (NYSE:HRB), now may be a good time to sell at least some of your position to lock in your profits. If you are considering the company as a prospective investment, I would recommend either waiting for a significant pullback in the share price or I would suggest taking a good, long look at one of the alternatives that are a better value currently.

The article There Are Better Ways To Play Tax Preparation originally appeared on Fool.com and is written by Matthew Frankel.

Matthew Frankel has no position in any stocks mentioned. The Motley Fool recommends Intuit. The Motley Fool owns shares of Intuit. Matthew is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.