We embraced hybrid work, enabling us to rationalize our real estate portfolio, executing 13 site consolidations or exits during the year. We also simplified our go-to-market organization, including streamlining our management structure. We made solid progress on our digital transformation efforts by driving additional automation and process improvements. We modernized our data infrastructure to leverage AI machine learning to deliver richer, data-driven insights from business decisions. Looking ahead, we are accelerating our generative AI capabilities, including rolling out AI tools like GitHub Copilot to approximately half of our developers as well as implementing HP-specific large language models to improve efficiencies through a chatbot for our sales and service representatives.

Further, there are significant opportunities ahead, across many additional use cases. Our third pillar is focused on simplifying our product portfolio, significantly reducing the number of platforms we support to drive agility and operating leverage. In FY ’23, the actions we took in Personal Systems continued to impact our overall performance. At the end of FY ’23, we were approximately halfway to our year-end FY ’24 goal of reducing our total number of Personal Systems platforms by approximately one-third. In addition, we made great progress reducing our commodity complexity by decreasing the number of client SKUs at our Personal Systems portfolio. We expect these initiatives will optimize our overall supplier ecosystem, increase our supply chain efficiency and drive better forecast capabilities.

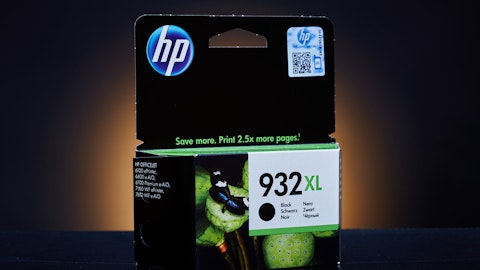

And in Print, by rationalizing our investments, we plan to simplify our Print portfolio to drive a 40% reduction in ink hardware platforms shipped by FY ’25. As we discussed at our Securities Analyst Meeting, we see significant opportunities ahead of us to focus on our Future Ready plan and position the company to optimize our cost structure and enhance our margin performance. Shifting to cash flow and capital allocation. Q4 cash flow from operations was strong at $2 billion, and free cash flow was $1.9 billion, on the strength of the sequential growth in Personal Systems. Free cash flow for fiscal year ’23 was approximately $3.1 billion, consistent with our outlook. The cash conversion cycle was minus 32 days in the quarter. This improved three days year-over-year, driven exclusively by an increase in days payable.

In Q4, we returned approximately $260 million to shareholders via cash dividends. We did not repurchase any shares in the quarter, given that we were in possession of material non-public information, but we expect to resume repurchases in Q1 and be active throughout FY ’24. For fiscal year ’23, we returned greater than $1.1 billion to shareholders and retired $1.6 billion of debt. Regarding FY ’24, we are reiterating our outlook provided at our Securities Analyst Meeting last month. We intend to return approximately 100% of our free cash flow to shareholders next year, as long as our debt-to-EBITDA ratio remains under 2x and unless higher ROI opportunities arise, such as strategic acquisitions. Looking forward to FY ’24, consistent with what we said at our October Securities Analyst Meeting, we assume the market will stabilize in our base case scenario, underlying that outlook for Personal Systems is for revenues to grow in-line with the personal systems market and for Print revenue to be in line with the print market.

We expect operating margins for both Personal Systems and Print to be solidly within their respective target ranges, as we continue to manage costs and pricing in this dynamic and uncertain environment. Regarding our non-GAAP FY ’24 EPS outlook, consistent with historical seasonality, we expect second-half performance will be greater than the first half. As we said at our Security Analyst Meeting, we expect corporate other expense for fiscal ’24 to be relatively flat year-over-year at approximately $1 billion. Keep in mind that due to the timing of stock compensation expense, we expect approximately one-third of FY ’24’s corporate other expense in Q1. And in Q1, we expect the economic and demand environment to remain challenging but stable.

As we continue to manage cost aggressively to help offset some of these pressures, we expect our operating profit margins for both Personal System and Print to be toward the high end of their respective target ranges for the quarter. Taking these considerations into account, we are providing the following outlook for Q1 and fiscal year 2024. We expect first quarter non-GAAP diluted net earnings per share to be in the range of $0.76 to $0.86, and first quarter GAAP diluted net earnings per share to be in the range of $0.60 to $0.70. We expect FY ’24 non-GAAP diluted net earnings per share to be in the range of $3.25 to $3.65, and FY ’24, GAAP diluted net earnings per share to be in the range of $2.68 to $3.08. In summary, we are pleased with our Q4 results, as we delivered on our commitments, even in light of the continued challenging macro environment.

Our longer-term financial framework that we outlined at our Securities Analyst Meeting last month, remains unchanged, and we have good momentum to execute on our near-term FY ’24 objectives. Our focus remains on profitable growth in the higher value segments of the market and structural cost savings across our P&L, while returning 100% of our free cash flow to our shareholders. And now, I would like to hand it back to the operator and open the call for your questions.

Operator: Thank you. And we will now begin the question-and-answer session. [Operator Instructions] And our first questioner today is Wamsi Mohan from Bank of America. Please go ahead.