Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

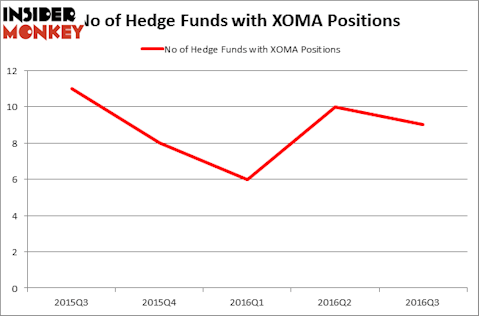

XOMA Corp (NASDAQ:XOMA) investors should be aware of a decrease in hedge fund interest in recent months. There were 10 hedge funds in our database with XOMA holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as ProNAi Therapeutics Inc (NASDAQ:DNAI), CytRx Corporation (NASDAQ:CYTR), and VAALCO Energy, Inc. (NYSE:EGY) to gather more data points.

Follow Xoma Royalty Corp (NASDAQ:XOMA)

Follow Xoma Royalty Corp (NASDAQ:XOMA)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

g0d4ather/Shutterstock.com

What have hedge funds been doing with XOMA Corp (NASDAQ:XOMA)?

At the end of the third quarter, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a 10% fall from the second quarter of 2016. The graph below displays the number of hedge funds with bullish positions in XOMA over the last 5 quarters, which bottomed out at the end of March before a strong rebound in Q2. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, D E Shaw, founded by David E. Shaw, holds the most valuable position in XOMA Corp (NASDAQ:XOMA). D E Shaw has a $1.8 million position in the stock. Coming in second is Millennium Management, one of the 10 largest hedge funds in the world, holding a $0.2 million position. Other professional money managers with similar optimism consist of John Overdeck and David Siegel’s Two Sigma Advisors, Jim Simons’ Renaissance Technologies, and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Because XOMA Corp (NASDAQ:XOMA) has witnessed a decline in interest from the entirety of the hedge funds we track, logic holds that there is a sect of funds who were dropping their full holdings by the end of the third quarter. Intriguingly, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners cut the biggest stake of all the investors watched by Insider Monkey, comprising an estimated $0.1 million in stock. Paul Tudor Jones’ fund, Tudor Investment Corp, also said goodbye to its small position in the stock.

Let’s check out hedge fund activity in other stocks similar to XOMA Corp (NASDAQ:XOMA). These stocks are ProNAi Therapeutics Inc (NASDAQ:DNAI), CytRx Corporation (NASDAQ:CYTR), VAALCO Energy, Inc. (NYSE:EGY), and Christopher & Banks Corporation (NYSE:CBK). This group of stocks’ market values are similar to XOMA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DNAI | 8 | 9093 | -1 |

| CYTR | 7 | 5519 | 1 |

| EGY | 9 | 4988 | 4 |

| CBK | 5 | 3455 | -3 |

As you can see these stocks had an average of 7 hedge funds with bullish positions and the average amount invested in these stocks was $6 million. That figure was $2 million in XOMA’s case. VAALCO Energy, Inc. (NYSE:EGY) is the most popular stock in this table. On the other hand Christopher & Banks Corporation (NYSE:CBK) is the least popular one with only 5 bullish hedge fund positions. XOMA Corp (NASDAQ:XOMA) is tied as the most popular stock in this group, but has the least amount of money invested in it. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are pouring money into. In this regard DNAI might be a better candidate to consider taking a long position in.

Disclosure: None