At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

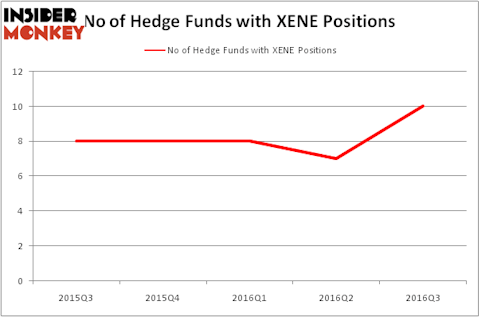

Xenon Pharmaceuticals Inc (NASDAQ:XENE) was in 10 hedge funds’ portfolios at the end of September. XENE has seen an increase in hedge fund sentiment of late. There were 7 hedge funds in our database with XENE positions at the end of the previous quarter. At the end of this article we will also compare XENE to other stocks including Vascular Biogenics Ltd (NASDAQ:VBLT), Evans Bancorp Inc. (NYSEAMEX:EVBN), and JMP Group Inc. (NYSE:JMP) to get a better sense of its popularity.

Follow Xenon Pharmaceuticals Inc. (NASDAQ:XENE)

Follow Xenon Pharmaceuticals Inc. (NASDAQ:XENE)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Keeping this in mind, let’s take a gander at the recent action surrounding Xenon Pharmaceuticals Inc (NASDAQ:XENE).

Hedge fund activity in Xenon Pharmaceuticals Inc (NASDAQ:XENE)

At the end of the third quarter, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 43% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in XENE over the last 5 quarters. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Mark Lampert’s Biotechnology Value Fund has the largest position in Xenon Pharmaceuticals Inc (NASDAQ:XENE), worth close to $25.2 million, amounting to 4.7% of its total 13F portfolio. Coming in second is Samuel Isaly of OrbiMed Advisors, with a $8.1 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism encompass Joseph Edelman’s Perceptive Advisors, Nathan Fischel’s DAFNA Capital Management and Wilbur Ross’s Invesco Private Capital (WL Ross). We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Consequently, some big names have been driving this bullishness. OrbiMed Advisors, led by Samuel Isaly, assembled the most valuable position in Xenon Pharmaceuticals Inc (NASDAQ:XENE). OrbiMed Advisors had $8.1 million invested in the company at the end of the quarter. Ken Greenberg and David Kim’s Ghost Tree Capital also made a $2.6 million investment in the stock during the quarter. The only other fund with a new position in the stock is James Dondero’s Highland Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Xenon Pharmaceuticals Inc (NASDAQ:XENE) but similarly valued. We will take a look at Vascular Biogenics Ltd (NASDAQ:VBLT), Evans Bancorp Inc. (NYSEAMEX:EVBN), JMP Group Inc. (NYSE:JMP), and Gemphire Therapeutics Inc (NASDAQ:GEMP). This group of stocks’ market valuations are similar to XENE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VBLT | 4 | 5088 | -1 |

| EVBN | 2 | 7191 | -2 |

| JMP | 2 | 241 | 0 |

| GEMP | 4 | 14357 | 4 |

As you can see these stocks had an average of 3 hedge funds with bullish positions and the average amount invested in these stocks was $7 million. That figure was $59 million in XENE’s case. Vascular Biogenics Ltd (NASDAQ:VBLT) is the most popular stock in this table. On the other hand Evans Bancorp Inc. (NYSEAMEX:EVBN) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Xenon Pharmaceuticals Inc (NASDAQ:XENE) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.