Insider Monkey tracks hedge funds, billionaires, and prominent value investors for a very simple reason: their consensus picks generally outperform the market. We aren’t the only research shop broadcasting this fact using a bullhorn. Here is what strategist Ben Snider said in Goldman Sachs’ periodic hedge fund report:

“Despite the strong track record of popular hedge fund stocks, investors often view high ownership as a negative trait when evaluating stock prospects. Clients often ask us to include hedge fund ownership data in stock screens, expressing a preference for buying ‘under-owned’ stocks.”

“In fact, during the past decade hedge fund popularity has been a more useful criterion for selecting stocks than valuations…. The signals from hedge fund popularity and valuation have been particularly useful in combination, especially for investors with slightly longer investment horizons. During the past decade, popular stocks have generally outperformed unpopular stocks across both 3- and 12-month investment horizons” Snider concluded.

It may sound like I am tooting my own horn, but Insider Monkey’s quarterly newsletter is actually superior to Goldman’s report. That’s because we separated the hedge fund favorites into long and short buckets. Our long bucket of hedge fund favorites returned 34.1% in the first half of 2019, whereas our short bucket of hedge fund favorites gained 21.4% during the same period. Hedge funds’ favorite top 20 stocks, on the other hand, returned 24% so far in 2019. You could have beaten the S&P 500 Index funds by 5.7 percentage points by investing in hedge funds’ top 20 picks in 2019, whereas you could have outperformed the index funds by 15.8 percentage points if you invested in our top hedge fund picks. You can try out our newsletter free of charge for 14 days to see hedge funds’ latest best stock picks.

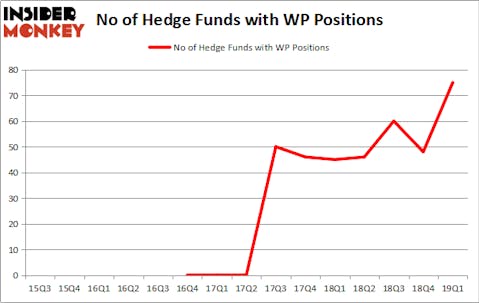

The #24 most popular stock among the 743 hedge funds tracked by Insider Monkey was Worldpay, Inc. (NYSE:WP). Worldpay was the 110th most popular stock among hedge funds at the end of December (see the 30 most popular stocks among hedge funds). Overall hedge fund sentiment towards Worldpay is currently at its all time high. This is usually a very bullish signal. We observed this in other stocks like Roku, Control4 Corp, Uniqure, Avalara, Lindblad Expedition, and Disney. Roku returned returned 45%, Control4 Corp returned 40%, Uniqure and Avalara delivered a 30% gain each, and Disney outperformed the market by 23 percentage points in Q2. Lindblad Expedition investors also experienced a relatively modest 15.2% gain during the same period.

We have to warn you against indiscriminately imitating hedge funds’ all stock picks. Hedge funds’ top 20 stock picks outperformed the S&P 500 Index funds by 5.7 percentage points this year, but hedge funds’ top 500 stock picks had the same return as the S&P 500 Index this quarter. Investing in a hedge fund’s 35th best idea doesn’t give you the same return as investing in a hedge fund’s best idea.

Clint Carlson of Carlson Capital

We’re going to take a look at the latest hedge fund action encompassing Worldpay, Inc. (NYSE:WP).

What have hedge funds been doing with Worldpay, Inc. (NYSE:WP)?

Heading into the second quarter of 2019, a total of 75 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 56% from the previous quarter. By comparison, 45 hedge funds held shares or bullish call options in WP a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Worldpay, Inc. (NYSE:WP) was held by Select Equity Group, which reported holding $525.8 million worth of stock at the end of March. It was followed by Citadel Investment Group with a $482.4 million position. Other investors bullish on the company included Diamond Hill Capital, Melvin Capital Management, and Steadfast Capital Management.

Consequently, key hedge funds were breaking ground themselves. Magnetar Capital, managed by Alec Litowitz and Ross Laser, assembled the largest position in Worldpay, Inc. (NYSE:WP). Magnetar Capital had $235.2 million invested in the company at the end of the quarter. Robert Emil Zoellner’s Alpine Associates also made a $166.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Aaron Cowen’s Suvretta Capital Management, Robert Boucai’s Newbrook Capital Advisors, and Clint Carlson’s Carlson Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Worldpay, Inc. (NYSE:WP) but similarly valued. We will take a look at eBay Inc (NASDAQ:EBAY), Johnson Controls International plc (NYSE:JCI), Constellation Brands, Inc. (NYSE:STZ), and Manulife Financial Corporation (NYSE:MFC). This group of stocks’ market values match WP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EBAY | 48 | 3933951 | 6 |

| JCI | 25 | 727926 | -1 |

| STZ | 38 | 2547745 | -24 |

| MFC | 16 | 323863 | -4 |

| Average | 31.75 | 1883371 | -5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.75 hedge funds with bullish positions and the average amount invested in these stocks was $1883 million. That figure was $5218 million in WP’s case. eBay Inc (NASDAQ:EBAY) is the most popular stock in this table. On the other hand Manulife Financial Corporation (NYSE:MFC) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Worldpay, Inc. (NYSE:WP) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.4% in Q2 and outperformed the S&P 500 ETF (SPY) by more than 2 percentage points. Hedge funds were also right about betting on WP as the stock returned 8% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.