The China factor

As has been the case since the Great Recession of 2008, the only bright spot for commodities has been China, and even that country showed signs of slowing in 2012. The good news: China is perking back upand could again set a positive tone for commodities — especially copper — in 2013. Analysts at Goldman Sachs have tallied up the various stimulus packages the provincial governments in China have proposed, and they came up with a stunning $3.2 trillion in ongoing investment. Much of that investment is going toward housing and transit systems. Their key takeaway: “We believe that a sustainable recovery in China’s infrastructure and property sector will be most beneficial for copper; this is a metal where China requires significant imports and where we think supply-side challenges will continue to keep the market in a relatively tight position.”

That’s also a view shared by analysts at Merrill Lynch, who predict copper could rally to $4 a pound in 2013. “China has shown increasing signs of green shoots in a wide range of sectors (i.e., transportation, export, property market)… (which) suggests that demand for the cyclical mined commodities could improve.” That forecast move to $4 a pound may prove to be conservative, considering copper prices stood above $4.50 a pound in the summer of 2011, the last time the global economy looked poised for synchronized growth.

But if you compare the profit outlook for copper producers to copper price forecasts, then you’ll find a curious disconnect: “North American copper equities are pricing a median copper price of $2.15 [a pound], because the market does not believe copper prices above $3 [a pound] are sustainable. However, we believe supply constraints through 2020 support a more constructive view,” said Merrill’s analysts.

The key takeaway is that copper prices don’t need to rally to $4 a pound as these analysts anticipate. Instead, prices merely need to hold their ground so these stocks can finally get appreciation.

Freeport’s stumble

Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX), the world’s largest copper producer, would have been a clear beneficiary of a firm copper market. But the company’s recently-announced plan to buy Plains Exploration & Production Company (NYSE:PXP) and Mcmoran Exploration Co (NYSE:MMR), a pair of oil and gas plays, has changed that thesis. Freeport McMoRan has subsequently shed several billion dollars of market value as investors soured on a now weaker balance sheet and a more muddled business mix. More than likely, these deals will bear fruit and shares are likely to rebound as the company starts to deliver on promisedcash flow targets. Still, this is no longer the “no-brainer” copper pure play it once was.

Instead, you may want to check out Southern Copper Corp (NYSE:SCCO). The Arizona-based firm owns a network of low-cost mines in Peru, Mexico and Chile. The company’s mines are so productive, thanks to easily accessible copper concentrations, that it costs this company less than 35 cents a pound to mine, or roughly 10% of the global spot-market selling price.

This is one of the few companies in position to expand output, with plans to hike copper production from 640,000 tons of copper this year to 1 million tons by 2016. Many of the company’s rivals are having a hard time finding productive new mining opportunities, which helps explain why long-term supply may stay constrained. Finding the companies that won’t have supply constraints, like Southern Copper, ensures you can profit from firm copper prices and rising copper output.

The ETF route

If you’d rather steer clear of the copper miners and prefer exposure to the commodity itself, then exchange-traded funds (ETFs) are the better route. Unfortunately, most of them are very thinly traded. The most liquid of the group: The iPath Dow Jones UBS Copper Total Return Sub-Index (NYSEARCA:JJC), which has more than $100 million in assets under management and trades more than 50,000 shares a day. This ETF owns copper futures contracts and would post solid gains if copper moved toward $4 a pound in 2013, as Merrill Lynch’s analysts suggest.

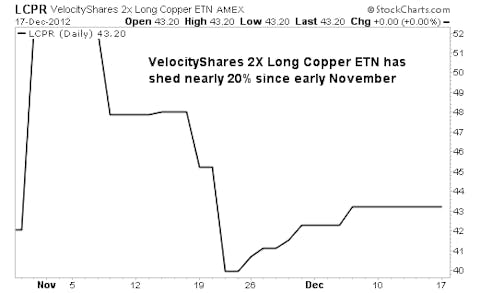

If you are willing to tolerate thin trading volumes, then the VelocityShares 2X Long Copper ETN(exchange-traded note) (Nasdaq: LCPR) is even more highly leveraged to copper prices. This fund has shed roughly 20% since early November, creating a fresh entry point.

Risks to Consider: As noted earlier, China drives commodity prices, and any major slowdown in that economy would force copper prices lower.

Action to Take –> Commodities have been out of favor for much of 2012, thanks to global macro-economic concerns. Yet as the United States, China, Brazil and other economies expand in 2013, and as funds flow out of bonds, commodities could be a major beneficiary. Copper is an especially economically-sensitive commodity, thanks to its outsized role in construction. Considering the recent positive data points emanating from the U.S. housing sector, coupled with fresh stimulus efforts in China, it may be time for copper to shine in 2013.

This article was originally written by David Sterman, and posted on StreetAuthority.