Hedge funds are not perfect. They have their bad picks just like everyone else. Valeant, a stock hedge funds have loved, lost 79% during the last 12 months ending in November 21. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 mid-cap stocks among the best performing hedge funds yielded an average return of 18% in the same time period, vs. a gain of 7.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of The Cooper Companies Inc (NYSE:COO).

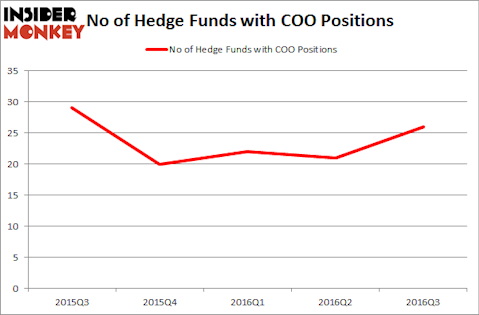

Is The Cooper Companies Inc (NYSE:COO) a buy here? Prominent investors are turning bullish. The number of bullish hedge fund bets improved by 5 recently. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as The WhiteWave Foods Co (NYSE:WWAV), LG Display Co Ltd. (ADR) (NYSE:LPL), and Ally Financial Inc (NYSE:ALLY) to gather more data points.

Follow Cooper Companies Inc. (NASDAQ:COO)

Follow Cooper Companies Inc. (NASDAQ:COO)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Olesia Bilkei/Shutterstock.com

What does the smart money think about The Cooper Companies Inc (NYSE:COO)?

At the end of the third quarter, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, an increase of 24% from one quarter earlier, helping hedge fund sentiment rise above its recent depressed levels. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Point72 Asset Management, run by Steve Cohen, holds the number one position in The Cooper Companies Inc (NYSE:COO). According to regulatory filings, the fund has a $48.5 million position in the stock. The second largest stake is held by OrbiMed Advisors, managed by Samuel Isaly, which holds a $44.8 million position. Some other peers that hold long positions encompass David Blood and Al Gore’s Generation Investment Management, Israel Englander’s Millennium Management, and Barry Dargan’s Intermede Investment Partners.