There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze KVH Industries, Inc. (NASDAQ:KVHI).

KVH Industries, Inc. (NASDAQ:KVHI) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 6 hedge funds’ portfolios at the end of September, same as at the end of June. At the end of this article we will also compare KVHI to other stocks including Genocea Biosciences Inc (NASDAQ:GNCA), Genie Energy Ltd (NYSE:GNE), and Willdan Group, Inc. (NASDAQ:WLDN) to get a better sense of its popularity.

Follow Kvh Industries Inc (NASDAQ:KVHI)

Follow Kvh Industries Inc (NASDAQ:KVHI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Sergey Nivens/Shutterstock.com

How are hedge funds trading KVH Industries, Inc. (NASDAQ:KVHI)?

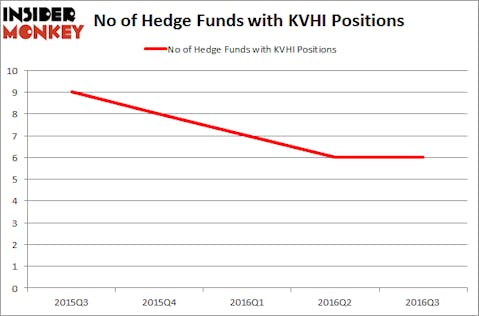

Heading into the fourth quarter of 2016, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards KVHI over the last 5 quarters, which steadily declined in the three quarter prior to Q3. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Thomas E. Claugus’ GMT Capital has the biggest position in KVH Industries, Inc. (NASDAQ:KVHI), worth close to $8.1 million. On GMT Capital’s heels is Harvey Partners, led by Jeffrey Moskowitz, holding a $3.1 million position; the fund has 3.7% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism consist of Brandon Osten’s Venator Capital Management, Renaissance Technologies, one of the largest hedge funds in the world, and Chuck Royce’s Royce & Associates. We should note that Harvey Partners is among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

We view hedge fund activity in the stock as unfavorable, but in this case there was only a single hedge fund selling its entire position: Manatuck Hill Partners. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Venator Capital Management).

Let’s now take a look at hedge fund activity in other stocks similar to KVH Industries, Inc. (NASDAQ:KVHI). These stocks are Genocea Biosciences Inc (NASDAQ:GNCA), Genie Energy Ltd (NYSE:GNE), Willdan Group, Inc. (NASDAQ:WLDN), and Fortress Biotech Inc (NASDAQ:FBIO). This group of stocks’ market valuations resemble KVHI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GNCA | 6 | 8042 | -2 |

| GNE | 5 | 5897 | -2 |

| WLDN | 4 | 6888 | 4 |

| FBIO | 2 | 5451 | -2 |

As you can see these stocks had an average of 4 hedge funds with bullish positions and the average amount invested in these stocks was $7 million. That figure was $17 million in KVHI’s case. Genocea Biosciences Inc (NASDAQ:GNCA) is the most popular stock in this table. On the other hand Fortress Biotech Inc (NASDAQ:FBIO) is the least popular one with only 2 bullish hedge fund positions. KVH Industries, Inc. (NASDAQ:KVHI) is tied as the most popular stock in this group and has the most money invested in it of the 5. This is a positive signal, as we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KVHI might be a good candidate to consider taking a long position in.

Disclosure: None