The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small-cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small-cap stocks. In this article, we take a closer look at Nantkwest Inc (NASDAQ:NK) from the perspective of those successful funds.

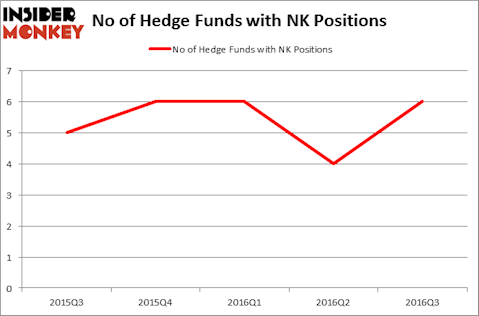

Is Nantkwest Inc (NASDAQ:NK) worth your attention right now? Money managers are indeed taking an optimistic view. The number of bullish hedge fund investments increased by 2 recently. NK was in 6 hedge funds’ portfolios at the end of September. There were 4 hedge funds in our database with NK positions at the end of June. At the end of this article we will also compare NK to other stocks including AngioDynamics, Inc. (NASDAQ:ANGO), Cerus Corporation (NASDAQ:CERS), and Thermon Group Holdings Inc (NYSE:THR) to get a better sense of its popularity.

Follow Immunitybio Inc. (NASDAQ:IBRX)

Follow Immunitybio Inc. (NASDAQ:IBRX)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

everything possible/Shutterstock.com

What have hedge funds been doing with Nantkwest Inc (NASDAQ:NK)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 50% jump from the previous quarter. Below, you can check out the change in hedge fund sentiment towards NK over the last 5 quarters, which has been relatively stable. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Leonard A. Potter’s Wildcat Capital Management has the largest position in Nantkwest Inc (NASDAQ:NK), worth close to $34.9 million, accounting for 8.3% of its total 13F portfolio. On Wildcat Capital Management’s heels is venBio Select Advisor, led by Behzad Aghazadeh, holding a $0.6 million position. Remaining peers that hold long positions comprise Glenn Russell Dubin’s Highbridge Capital Management, Michael Kao’s Akanthos Capital, and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

As industry-wide interest jumped, specific money managers have pushed into Nantkwest Inc (NASDAQ:NK) headfirst. Highbridge Capital Management initiated the largest position in Nantkwest Inc (NASDAQ:NK). Highbridge Capital Management had $0.2 million invested in the company at the end of the quarter. Akanthos Capital also initiated a $0.2 million position during the quarter. The only other fund with a new position in the stock is Citadel Investment Group.

Let’s check out hedge fund activity in other stocks similar to Nantkwest Inc (NASDAQ:NK). We will take a look at AngioDynamics, Inc. (NASDAQ:ANGO), Cerus Corporation (NASDAQ:CERS), Thermon Group Holdings Inc (NYSE:THR), and Eastman Kodak Co. (NYSE:KODK). This group of stocks’ market valuations match NK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ANGO | 17 | 138860 | 5 |

| CERS | 11 | 108267 | 0 |

| THR | 4 | 13804 | -2 |

| KODK | 14 | 155395 | 3 |

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $104 million. That figure was $36 million in NK’s case. AngioDynamics, Inc. (NASDAQ:ANGO) is the most popular stock in this table. On the other hand Thermon Group Holdings Inc (NYSE:THR) is the least popular one with only 4 bullish hedge fund positions. Nantkwest Inc (NASDAQ:NK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ANGO might be a better candidate to consider taking a long position in.

Disclosure: None