Netflix, Inc. (NASDAQ:NFLX) announced its fourth quarter fiscal results on Jan. 23, and the very next day its stock price jumped 42%. In the 10 trading days following results, the stock gained almost 80%.

It has been a dream run for Netflix in 2013 — the stock has appreciated almost 100%: from $92.59 on Dec. 31, it closed at $184.41 on Feb. 6. Is it driven by results and the company’s performance and future prospects? Will the company’s earnings be able to justify such high equity valuation? Or is it just news driven? Let’s have a look.

Earnings

Netflix reported quarterly revenue of $945.24 million for the period ended Dec. 31, which was 8% higher than the same quarter last year. However, revenue for the full year ended December 2012 was $3.6 billion, up by almost 13%.

Quarterly EPS for the fourth fiscal quarter fell to $0.14 from the $0.66 reported in the same quarter prior year. The drop in EPS for the full year was even more drastic, and fell from $4.28 to $0.31 per share.

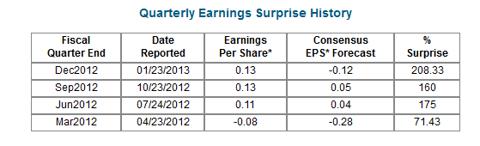

However, quarter-oover-quarter EPS reveals a different picture.

Source: www.nasdaq.com

Netflix has been able to increase its subscriber base due to high spending on popular movies and shows. Streaming subscriptions increased by 9.74 million in 2012, with international subscriptions tripling to 6.12 million.

Netflix has belied theories that streaming will not be able to provide margins as good as those of the DVD business. Fact is that margins for domestic streaming business registered YOY improvement of more than 7%.

The drop in income is more from the drop in DVD business, which was an extremely high-margin business for the company. The increase in subscribers has not been sufficient for compensating losses due to the 26% decline in DVD subscriptions.

Future Prospects and Challenges

The negative cash flow is a big worrying factor. This can potentially lead to further borrowing or issuance of fresh equity if the company is not able to generate sufficient cash from operations to fund its expensive content deals.

The company expects streaming profits in the next quarter to be more than profits from the DVD business. This is something that has not happened before in the history of the company. CEO Reed Hastings said that he does not intend to raise the subscription rate from $7.99 per month, and instead will focus on increasing subscriptions to 50 million.

One of Netflix’s major competitors, Amazon.com, Inc. (NASDAQ:AMZN), has huge cash reserves and may beat it in the race to acquire new content. Amazon has a current cash flow of $4.18 billion cash and cash equivalents amounting to $8.08 billion. Comparable figures for Netflix are only $22.76 million and $290 million, respectively. Netflix, however, has a slightly better operating margin (1.39%) than Amazon (1.11%).

Another threat is presented by Redbox DVD rental machines from Coinstar, Inc. (NASDAQ:CSTR) and its partnership with Verizon Communications Inc. (NYSE:VZ). Coinstar is engaged in the business of providing convenient and automated retail solutions with major revenue coming from Redbox kiosks where customers can order or rent movies and games. Although it’s a smaller company as compared to Netflix in terms of market cap ($1.43 billion, compared to Netflix’s $9.96 billion), Coinstar has a much healthier operating profit of above 12%.