Several hedge fund billionaires took advantage of the sharp declines in broader market indices during the 5 hours following Donald Trump’s election victory. In this case markets wised up pretty quickly and the selloffs turned into rallies. Information disseminates very quickly in liquid markets, however, the rate of adjustment is usually slower when it comes to much smaller and less liquid markets. By tracking the hedge fund sentiment in publicly traded US stocks Insider Monkey aims to tap into hedge funds’ wisdom without paying them an arm and a leg. Historically their stock picks in small-cap stocks proved to be the most profitable. Let’s study the hedge fund sentiment to see how recent events affected their ownership of Great Plains Energy Incorporated (NYSE:GXP) during the quarter.

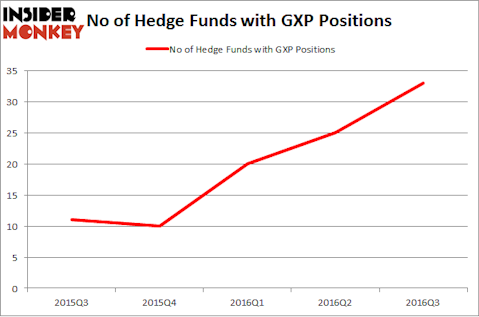

Is Great Plains Energy Incorporated (NYSE:GXP) an exceptional stock to buy now? Hedge funds are actually getting very excited. The number of long hedge fund bets swelled by 8 in recent months. GXP was in 33 hedge funds’ portfolios at the end of the third quarter of 2016. There were 25 hedge funds in our database with GXP holdings at the end of June. At the end of this article we will also compare GXP to other stocks including Lincoln Electric Holdings, Inc. (NASDAQ:LECO), Research In Motion Ltd (NASDAQ:BBRY), and OneMain Holdings Inc (NYSE:OMF) to get a better sense of its popularity.

Follow Great Plains Energy Inc (NYSE:GXP)

Follow Great Plains Energy Inc (NYSE:GXP)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

bluebay/Shutterstock.com

What have hedge funds been doing with Great Plains Energy Incorporated (NYSE:GXP)?

At the end of the third quarter, a total of 33 of the hedge funds tracked by Insider Monkey were long this stock, a gain of 32% from the second quarter of 2016. By comparison, 10 hedge funds held shares or bullish call options in GXP heading into this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Millennium Management has the biggest position in Great Plains Energy Incorporated (NYSE:GXP), worth close to $227.7 million. The second most bullish fund manager is Stuart J. Zimmer of Zimmer Partners, with a $137.2 million position; 3.7% of its 13F portfolio is allocated to the company. Other peers that hold long positions encompass Ken Griffin’s Citadel Investment Group, and Benjamin A. Smith’s Laurion Capital Management. We should note that Zimmer Partners is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.