Many investors, including Paul Tudor Jones or Stan Druckenmiller, have been saying before last year’s Q4 market crash that the stock market is overvalued due to a low interest rate environment that leads to companies swapping their equity for debt and focusing mostly on short-term performance such as beating the quarterly earnings estimates. In the first half of 2019, most investors recovered all of their Q4 losses as sentiment shifted and optimism dominated the US China trade negotiations. Nevertheless, many of the stocks that delivered strong returns in the first half still sport strong fundamentals and their gains were more related to the general market sentiment rather than their individual performance and hedge funds kept their bullish stance. In this article we will find out how hedge fund sentiment to Resideo Technologies, Inc. (NYSE:REZI) changed recently.

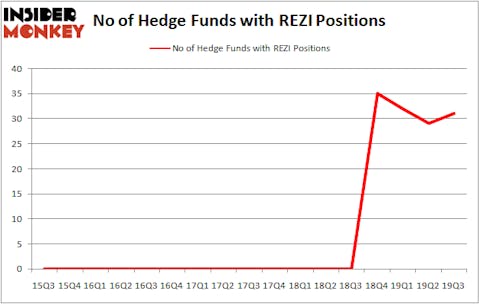

Is Resideo Technologies, Inc. (NYSE:REZI) a worthy investment right now? Prominent investors are betting on the stock. The number of bullish hedge fund positions rose by 2 lately. Our calculations also showed that REZI isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In the eyes of most shareholders, hedge funds are viewed as slow, outdated investment vehicles of the past. While there are greater than 8000 funds in operation at the moment, Our researchers hone in on the masters of this club, about 750 funds. These hedge fund managers direct the majority of all hedge funds’ total asset base, and by keeping an eye on their first-class stock picks, Insider Monkey has come up with a few investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Keeping this in mind we’re going to take a look at the latest hedge fund action encompassing Resideo Technologies, Inc. (NYSE:REZI).

Hedge fund activity in Resideo Technologies, Inc. (NYSE:REZI)

Heading into the fourth quarter of 2019, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards REZI over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Praesidium Investment Management held the most valuable stake in Resideo Technologies, Inc. (NYSE:REZI), which was worth $87.6 million at the end of the third quarter. On the second spot was Freshford Capital Management which amassed $66.6 million worth of shares. Carlson Capital, Rubric Capital Management, and GAMCO Investors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Freshford Capital Management allocated the biggest weight to Resideo Technologies, Inc. (NYSE:REZI), around 12.18% of its 13F portfolio. Praesidium Investment Management is also relatively very bullish on the stock, dishing out 5.74 percent of its 13F equity portfolio to REZI.

As industrywide interest jumped, key hedge funds were leading the bulls’ herd. Rubric Capital Management, managed by David Rosen, created the most outsized position in Resideo Technologies, Inc. (NYSE:REZI). Rubric Capital Management had $25.8 million invested in the company at the end of the quarter. Bernard Selz’s Selz Capital also initiated a $6.1 million position during the quarter. The following funds were also among the new REZI investors: Brandon Haley’s Holocene Advisors, Michael Gelband’s ExodusPoint Capital, and Charles Paquelet’s Skylands Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Resideo Technologies, Inc. (NYSE:REZI) but similarly valued. We will take a look at NetScout Systems, Inc. (NASDAQ:NTCT), Essential Properties Realty Trust, Inc. (NYSE:EPRT), Northwest Bancshares, Inc. (NASDAQ:NWBI), and ForeScout Technologies, Inc. (NASDAQ:FSCT). This group of stocks’ market valuations are closest to REZI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTCT | 12 | 100240 | -2 |

| EPRT | 15 | 110452 | 0 |

| NWBI | 18 | 67833 | 5 |

| FSCT | 19 | 281431 | 1 |

| Average | 16 | 139989 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $140 million. That figure was $340 million in REZI’s case. ForeScout Technologies, Inc. (NASDAQ:FSCT) is the most popular stock in this table. On the other hand NetScout Systems, Inc. (NASDAQ:NTCT) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Resideo Technologies, Inc. (NYSE:REZI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately REZI wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on REZI were disappointed as the stock returned -41.7% so far in 2019 (through 12/23) and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 65 percent of these stocks already outperformed the market in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.