We are still in an overall bull market and many stocks that smart money investors were piling into surged in 2019. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 57% each. Hedge funds’ top 3 stock picks returned 44.6% this year and beat the S&P 500 ETFs by nearly 14 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Owens Corning (NYSE:OC).

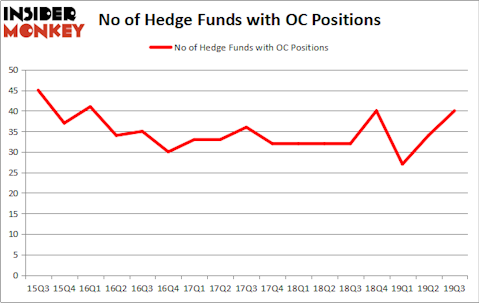

Owens Corning (NYSE:OC) was in 40 hedge funds’ portfolios at the end of September. OC investors should be aware of an increase in support from the world’s most elite money managers lately. There were 34 hedge funds in our database with OC holdings at the end of the previous quarter. Our calculations also showed that OC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In the financial world there are many formulas market participants employ to grade their stock investments. A duo of the most useful formulas are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the best investment managers can outpace the market by a significant amount (see the details here).

Ken Griffin of Citadel Investment Group

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. With all of this in mind we’re going to check out the recent hedge fund action surrounding Owens Corning (NYSE:OC).

Hedge fund activity in Owens Corning (NYSE:OC)

At the end of the third quarter, a total of 40 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 18% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards OC over the last 17 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the biggest position in Owens Corning (NYSE:OC). Citadel Investment Group has a $223.5 million position in the stock, comprising 0.1% of its 13F portfolio. On Citadel Investment Group’s heels is Long Pond Capital, led by John Khoury, holding a $204.4 million position; the fund has 5.3% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism encompass Lee Ainslie’s Maverick Capital, Parag Vora’s HG Vora Capital Management and Phill Gross and Robert Atchinson’s Adage Capital Management. In terms of the portfolio weights assigned to each position HG Vora Capital Management allocated the biggest weight to Owens Corning (NYSE:OC), around 12.11% of its 13F portfolio. Park Presidio Capital is also relatively very bullish on the stock, setting aside 6.69 percent of its 13F equity portfolio to OC.

Consequently, key hedge funds were breaking ground themselves. Suvretta Capital Management, managed by Aaron Cowen, created the most outsized position in Owens Corning (NYSE:OC). Suvretta Capital Management had $40.4 million invested in the company at the end of the quarter. Josh Donfeld and David Rogers’s Castle Hook Partners also initiated a $31.1 million position during the quarter. The other funds with brand new OC positions are Principal Global Investors’s Columbus Circle Investors, Brandon Haley’s Holocene Advisors, and Renaissance Technologies.

Let’s also examine hedge fund activity in other stocks similar to Owens Corning (NYSE:OC). These stocks are WABCO Holdings Inc. (NYSE:WBC), Starwood Property Trust, Inc. (NYSE:STWD), Algonquin Power & Utilities Corp. (NYSE:AQN), and Bruker Corporation (NASDAQ:BRKR). This group of stocks’ market caps match OC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WBC | 29 | 1218154 | -4 |

| STWD | 18 | 158291 | 4 |

| AQN | 15 | 211065 | 6 |

| BRKR | 21 | 272235 | -6 |

| Average | 20.75 | 464936 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $465 million. That figure was $1306 million in OC’s case. WABCO Holdings Inc. (NYSE:WBC) is the most popular stock in this table. On the other hand Algonquin Power & Utilities Corp. (NYSE:AQN) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Owens Corning (NYSE:OC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on OC as the stock returned 50.4% so far in 2019 (through 12/23) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.