While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and deteriorating expectations towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the third quarter and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Las Vegas Sands Corp. (NYSE:LVS) and see how the stock performed in comparison to hedge funds’ consensus picks.

Hedge fund interest in Las Vegas Sands Corp. (NYSE:LVS) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare LVS to other stocks including Metlife Inc (NYSE:MET), BCE Inc. (NYSE:BCE), and Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) to get a better sense of its popularity.

In the financial world there are dozens of formulas investors can use to appraise stocks. A duo of the most under-the-radar formulas are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the top fund managers can outclass the market by a healthy margin (see the details here).

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. With all of this in mind we’re going to analyze the key hedge fund action encompassing Las Vegas Sands Corp. (NYSE:LVS).

Hedge fund activity in Las Vegas Sands Corp. (NYSE:LVS)

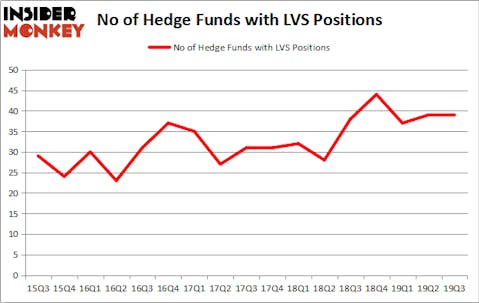

At the end of the third quarter, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. By comparison, 38 hedge funds held shares or bullish call options in LVS a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

More specifically, Melvin Capital Management was the largest shareholder of Las Vegas Sands Corp. (NYSE:LVS), with a stake worth $376.5 million reported as of the end of September. Trailing Melvin Capital Management was Millennium Management, which amassed a stake valued at $264.6 million. D1 Capital Partners, Renaissance Technologies, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Springowl Associates allocated the biggest weight to Las Vegas Sands Corp. (NYSE:LVS), around 4.78% of its 13F portfolio. LMR Partners is also relatively very bullish on the stock, dishing out 3.26 percent of its 13F equity portfolio to LVS.

Due to the fact that Las Vegas Sands Corp. (NYSE:LVS) has faced falling interest from the aggregate hedge fund industry, logic holds that there is a sect of fund managers who were dropping their full holdings last quarter. Interestingly, Steve Cohen’s Point72 Asset Management sold off the biggest stake of the 750 funds monitored by Insider Monkey, valued at an estimated $34.3 million in stock. Louis Bacon’s fund, Moore Global Investments, also dropped its stock, about $14.8 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Las Vegas Sands Corp. (NYSE:LVS) but similarly valued. These stocks are Metlife Inc (NYSE:MET), BCE Inc. (NYSE:BCE), Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX), and Tesla Inc. (NASDAQ:TSLA). This group of stocks’ market caps are similar to LVS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MET | 35 | 2050364 | 9 |

| BCE | 13 | 415810 | -1 |

| VRTX | 46 | 2296101 | 6 |

| TSLA | 28 | 570594 | -9 |

| Average | 30.5 | 1333217 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.5 hedge funds with bullish positions and the average amount invested in these stocks was $1333 million. That figure was $1983 million in LVS’s case. Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) is the most popular stock in this table. On the other hand BCE Inc. (NYSE:BCE) is the least popular one with only 13 bullish hedge fund positions. Las Vegas Sands Corp. (NYSE:LVS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on LVS, though not to the same extent, as the stock returned 40.3% during 2019 (as of 12/23) and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.