We are still in an overall bull market and many stocks that smart money investors were piling into surged in 2019. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained more than 57% each. Hedge funds’ top 3 stock picks returned 45.7% last year and beat the S&P 500 ETFs by more than 14 percentage points. That’s a big deal. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

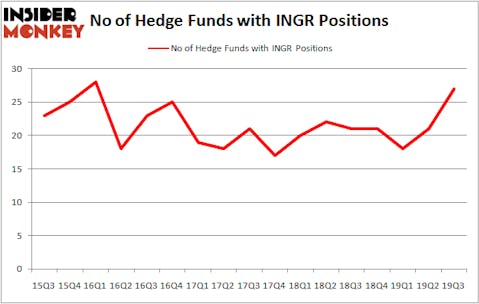

Ingredion Inc (NYSE:INGR) investors should be aware of an increase in hedge fund sentiment recently. Our calculations also showed that INGR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

To most traders, hedge funds are seen as slow, outdated financial tools of the past. While there are more than 8000 funds trading at the moment, We hone in on the bigwigs of this group, around 750 funds. These investment experts control bulk of the smart money’s total capital, and by shadowing their highest performing investments, Insider Monkey has brought to light a few investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

David Harding of Winton Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Now let’s take a look at the fresh hedge fund action regarding Ingredion Inc (NYSE:INGR).

What have hedge funds been doing with Ingredion Inc (NYSE:INGR)?

At Q3’s end, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 29% from one quarter earlier. By comparison, 21 hedge funds held shares or bullish call options in INGR a year ago. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Cliff Asness’s AQR Capital Management has the most valuable position in Ingredion Inc (NYSE:INGR), worth close to $111 million, accounting for 0.1% of its total 13F portfolio. The second largest stake is held by D E Shaw, led by David E. Shaw, holding a $58.4 million position; 0.1% of its 13F portfolio is allocated to the stock. Other professional money managers that are bullish contain David Harding’s Winton Capital Management, Israel Englander’s Millennium Management and Steve Cohen’s Point72 Asset Management. In terms of the portfolio weights assigned to each position Winton Capital Management allocated the biggest weight to Ingredion Inc (NYSE:INGR), around 0.4% of its 13F portfolio. Cerebellum Capital is also relatively very bullish on the stock, setting aside 0.29 percent of its 13F equity portfolio to INGR.

With a general bullishness amongst the heavyweights, specific money managers were leading the bulls’ herd. Balyasny Asset Management, managed by Dmitry Balyasny, assembled the biggest position in Ingredion Inc (NYSE:INGR). Balyasny Asset Management had $2.7 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also made a $1.9 million investment in the stock during the quarter. The other funds with new positions in the stock are Israel Englander’s Millennium Management, William B. Gray’s Orbis Investment Management, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now take a look at hedge fund activity in other stocks similar to Ingredion Inc (NYSE:INGR). We will take a look at Cloudflare, Inc. (NYSE:NET), Suzano S.A. (NYSE:SUZ), Amarin Corporation plc (NASDAQ:AMRN), and Grupo Aeroportuario del Pacifico, S.A.B. de C.V. (NYSE:PAC). This group of stocks’ market values are similar to INGR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NET | 33 | 144754 | 33 |

| SUZ | 4 | 36039 | 2 |

| AMRN | 29 | 1392510 | -4 |

| PAC | 3 | 93322 | -1 |

| Average | 17.25 | 416656 | 7.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $417 million. That figure was $343 million in INGR’s case. Cloudflare, Inc. (NYSE:NET) is the most popular stock in this table. On the other hand Grupo Aeroportuario del Pacifico, S.A.B. de C.V. (NYSE:PAC) is the least popular one with only 3 bullish hedge fund positions. Ingredion Inc (NYSE:INGR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately INGR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on INGR were disappointed as the stock returned 4.7% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.