Last year’s fourth quarter was a rough one for investors and many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 41.1% in 2019 (through December 23) and outperformed the S&P 500 ETF by more than 10 percentage points. In this article we will study how hedge fund sentiment towards Ingersoll-Rand Plc (NYSE:IR) changed during the third quarter and how the stock performed in comparison to hedge fund consensus stocks.

Hedge fund interest in Ingersoll-Rand Plc (NYSE:IR) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Paychex, Inc. (NASDAQ:PAYX), MPLX LP (NYSE:MPLX), and Brown-Forman Corporation (NYSE:BF) to gather more data points. Our calculations also showed that IR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

Today there are tons of formulas market participants have at their disposal to analyze their stock investments. A pair of the best formulas are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the elite fund managers can trounce the market by a superb amount (see the details here).

David Blood of Generation Investment Management

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. With all of this in mind let’s take a look at the key hedge fund action encompassing Ingersoll-Rand Plc (NYSE:IR).

How have hedgies been trading Ingersoll-Rand Plc (NYSE:IR)?

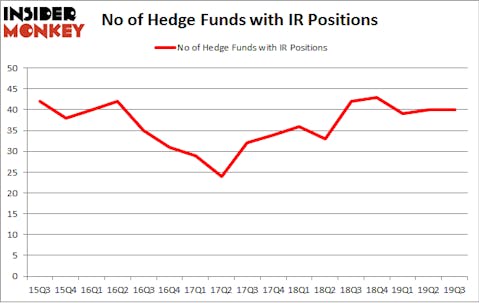

Heading into the fourth quarter of 2019, a total of 40 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards IR over the last 17 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Ingersoll-Rand Plc (NYSE:IR) was held by Generation Investment Management, which reported holding $350.8 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $303.4 million position. Other investors bullish on the company included Holocene Advisors, Impax Asset Management, and AQR Capital Management. In terms of the portfolio weights assigned to each position Bristol Gate Capital Partners allocated the biggest weight to Ingersoll-Rand Plc (NYSE:IR), around 4.67% of its 13F portfolio. Gates Capital Management is also relatively very bullish on the stock, setting aside 3.66 percent of its 13F equity portfolio to IR.

Seeing as Ingersoll-Rand Plc (NYSE:IR) has experienced falling interest from the aggregate hedge fund industry, logic holds that there was a specific group of hedgies that decided to sell off their full holdings last quarter. It’s worth mentioning that Aaron Cowen’s Suvretta Capital Management cut the largest stake of all the hedgies watched by Insider Monkey, totaling close to $96 million in stock. Alexander Mitchell’s fund, Scopus Asset Management, also said goodbye to its stock, about $22.3 million worth. These transactions are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Ingersoll-Rand Plc (NYSE:IR) but similarly valued. We will take a look at Paychex, Inc. (NASDAQ:PAYX), MPLX LP (NYSE:MPLX), Brown-Forman Corporation (NYSE:BF), and IQVIA Holdings, Inc. (NYSE:IQV). This group of stocks’ market valuations match IR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAYX | 28 | 871198 | -6 |

| MPLX | 13 | 486509 | 2 |

| BF | 21 | 632843 | -7 |

| IQV | 64 | 4469195 | -3 |

| Average | 31.5 | 1614936 | -3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.5 hedge funds with bullish positions and the average amount invested in these stocks was $1615 million. That figure was $1725 million in IR’s case. IQVIA Holdings, Inc. (NYSE:IQV) is the most popular stock in this table. On the other hand MPLX LP (NYSE:MPLX) is the least popular one with only 13 bullish hedge fund positions. Ingersoll-Rand Plc (NYSE:IR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on IR as the stock returned 50.4% in 2019 (through December 23rd) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.