Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Cenovus Energy Inc (NYSE:CVE) and compare its performance to hedge funds’ consensus picks in 2019.

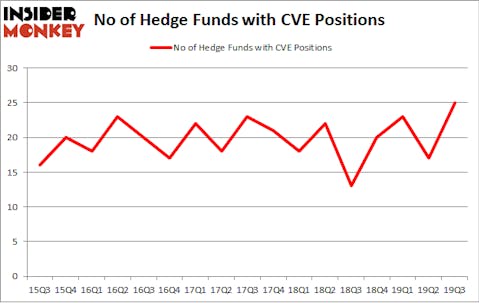

Is Cenovus Energy Inc (NYSE:CVE) the right investment to pursue these days? Hedge funds are taking an optimistic view. The number of long hedge fund positions advanced by 8 in recent months. Our calculations also showed that CVE isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings). CVE was in 25 hedge funds’ portfolios at the end of September. There were 17 hedge funds in our database with CVE holdings at the end of the previous quarter.

To most investors, hedge funds are viewed as worthless, old investment tools of yesteryear. While there are over 8000 funds trading today, Our researchers look at the crème de la crème of this club, about 750 funds. These hedge fund managers have their hands on bulk of the smart money’s total asset base, and by keeping an eye on their best equity investments, Insider Monkey has unsheathed several investment strategies that have historically outstripped the market. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Jonathan Barrett of Luminus Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Now let’s review the latest hedge fund action surrounding Cenovus Energy Inc (NYSE:CVE).

Hedge fund activity in Cenovus Energy Inc (NYSE:CVE)

At Q3’s end, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of 47% from the previous quarter. On the other hand, there were a total of 13 hedge funds with a bullish position in CVE a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Pzena Investment Management held the most valuable stake in Cenovus Energy Inc (NYSE:CVE), which was worth $179 million at the end of the third quarter. On the second spot was Luminus Management which amassed $153 million worth of shares. Citadel Investment Group, MAK Capital One, and Lansdowne Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position MAK Capital One allocated the biggest weight to Cenovus Energy Inc (NYSE:CVE), around 20.34% of its 13F portfolio. Luminus Management is also relatively very bullish on the stock, earmarking 4.43 percent of its 13F equity portfolio to CVE.

As one would reasonably expect, some big names have jumped into Cenovus Energy Inc (NYSE:CVE) headfirst. Arosa Capital Management, managed by Till Bechtolsheimer, assembled the biggest position in Cenovus Energy Inc (NYSE:CVE). Arosa Capital Management had $15.9 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $14.7 million position during the quarter. The other funds with new positions in the stock are Sara Nainzadeh’s Centenus Global Management, Joseph Samuels’s Islet Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now review hedge fund activity in other stocks similar to Cenovus Energy Inc (NYSE:CVE). These stocks are Continental Resources, Inc. (NYSE:CLR), Alleghany Corporation (NYSE:Y), C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW), and Raymond James Financial, Inc. (NYSE:RJF). All of these stocks’ market caps match CVE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CLR | 37 | 434858 | 3 |

| Y | 26 | 404893 | 0 |

| CHRW | 23 | 300442 | 3 |

| RJF | 27 | 793083 | -8 |

| Average | 28.25 | 483319 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.25 hedge funds with bullish positions and the average amount invested in these stocks was $483 million. That figure was $635 million in CVE’s case. Continental Resources, Inc. (NYSE:CLR) is the most popular stock in this table. On the other hand C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW) is the least popular one with only 23 bullish hedge fund positions. Cenovus Energy Inc (NYSE:CVE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. A small number of hedge funds were also right about betting on CVE as the stock returned 47.2% in 2019 and outclassed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.