It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The Standard and Poor’s 500 Total Return Index ETFs returned 31.2% in 2019. Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 41.3% during the same period, with the majority of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ consensus stock picks generate superior risk-adjusted returns. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Brunswick Corporation (NYSE:BC).

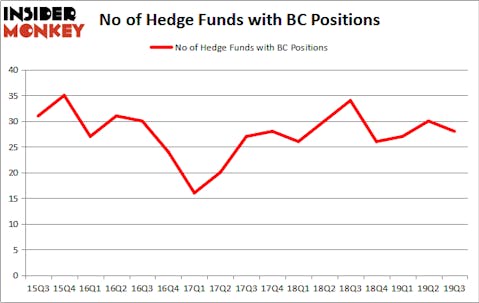

Brunswick Corporation (NYSE:BC) investors should pay attention to a decrease in enthusiasm from smart money in recent months. Our calculations also showed that BC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In the eyes of most traders, hedge funds are seen as unimportant, old financial vehicles of the past. While there are over 8000 funds with their doors open today, Our researchers choose to focus on the top tier of this club, approximately 750 funds. Most estimates calculate that this group of people command most of the hedge fund industry’s total capital, and by monitoring their finest equity investments, Insider Monkey has found a few investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Phill Gross of Adage Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. With all of this in mind let’s review the latest hedge fund action regarding Brunswick Corporation (NYSE:BC).

What does smart money think about Brunswick Corporation (NYSE:BC)?

At the end of the third quarter, a total of 28 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -7% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards BC over the last 17 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

More specifically, Cantillon Capital Management was the largest shareholder of Brunswick Corporation (NYSE:BC), with a stake worth $182 million reported as of the end of September. Trailing Cantillon Capital Management was Lakewood Capital Management, which amassed a stake valued at $174.8 million. Adage Capital Management, D E Shaw, and Arrowstreet Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Lakewood Capital Management allocated the biggest weight to Brunswick Corporation (NYSE:BC), around 5.96% of its 13F portfolio. Valueworks LLC is also relatively very bullish on the stock, setting aside 3.92 percent of its 13F equity portfolio to BC.

Due to the fact that Brunswick Corporation (NYSE:BC) has witnessed bearish sentiment from the aggregate hedge fund industry, logic holds that there was a specific group of money managers that slashed their entire stakes by the end of the third quarter. At the top of the heap, John Murphy’s Levin Easterly Partners cut the largest stake of all the hedgies monitored by Insider Monkey, totaling about $14.8 million in stock, and Jeffrey Altman’s Owl Creek Asset Management was right behind this move, as the fund dumped about $11.6 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest was cut by 2 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Brunswick Corporation (NYSE:BC). We will take a look at WPX Energy Inc (NYSE:WPX), Landstar System, Inc. (NASDAQ:LSTR), The Macerich Company (NYSE:MAC), and Selective Insurance Group, Inc. (NASDAQ:SIGI). This group of stocks’ market caps are closest to BC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WPX | 44 | 582500 | 4 |

| LSTR | 19 | 191180 | -3 |

| MAC | 22 | 136466 | 1 |

| SIGI | 24 | 120207 | 10 |

| Average | 27.25 | 257588 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.25 hedge funds with bullish positions and the average amount invested in these stocks was $258 million. That figure was $564 million in BC’s case. WPX Energy Inc (NYSE:WPX) is the most popular stock in this table. On the other hand Landstar System, Inc. (NASDAQ:LSTR) is the least popular one with only 19 bullish hedge fund positions. Brunswick Corporation (NYSE:BC) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on BC, though not to the same extent, as the stock returned 31.4% during 2019 and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.