The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Del Frisco’s Restaurant Group Inc (NASDAQ:DFRG).

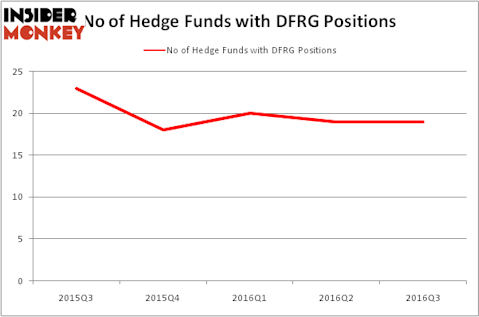

Hedge fund interest in Del Frisco’s Restaurant Group Inc (NASDAQ:DFRG) shares was flat at the end of last quarter, with 19 hedge funds bullish on the company. At the end of this article we will also compare DFRG to other stocks including Homeowners Choice Inc (NYSE:HCI), Emerge Energy Services LP (NYSE:EMES), and Potbelly Corp (NASDAQ:PBPB) to get a better sense of its popularity.

Follow Del Frisco's Restaurant Group Inc. (NASDAQ:DFRG)

Follow Del Frisco's Restaurant Group Inc. (NASDAQ:DFRG)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Luisa Fumi/Shutterstock.com

What have hedge funds been doing with Del Frisco’s Restaurant Group Inc (NASDAQ:DFRG)?

Heading into the fourth quarter of 2016, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, same as in the previous quarter. Below, you can check out the change in hedge fund sentiment towards DFRG over the last 5 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Amy Minella’s Cardinal Capital has the number one position in Del Frisco’s Restaurant Group Inc (NASDAQ:DFRG), worth close to $20.3 million. The second largest stake is held by Gabriel Plotkin of Melvin Capital Management, with a $20.2 million position. Remaining members of the smart money with similar optimism comprise Matthew Knauer and Mina Faltas’ Nokota Management, Brett Hendrickson’s Nokomis Capital and Arnaud Ajdler’s Engine Capital. We should note that Engine Capital is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Del Frisco’s Restaurant Group Inc (NASDAQ:DFRG) has weathered falling interest from the smart money, it’s easy to see that there were a few funds who were dropping their full holdings heading into Q4. Interestingly, Steven Boyd’s Armistice Capital said goodbye to the largest stake of all the investors watched by Insider Monkey, totaling about $3.9 million in stock. Constantinos J. Christofilis’s fund, Archon Capital Management, also dropped its stock, about $1.5 million worth.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Del Frisco’s Restaurant Group Inc (NASDAQ:DFRG) but similarly valued. These stocks are Homeowners Choice Inc (NYSE:HCI), Emerge Energy Services LP (NYSE:EMES), Potbelly Corp (NASDAQ:PBPB), and Cohu, Inc. (NASDAQ:COHU). This group of stocks’ market valuations resemble DFRG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HCI | 7 | 11809 | 1 |

| EMES | 4 | 22877 | 4 |

| PBPB | 14 | 35210 | -2 |

| COHU | 14 | 24630 | 4 |

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $24 million. That figure was $76 million in DFRG’s case. Potbelly Corp (NASDAQ:PBPB) is the most popular stock in this table. On the other hand Emerge Energy Services LP (NYSE:EMES) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Del Frisco’s Restaurant Group Inc (NASDAQ:DFRG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Suggested Articles:

Countries With The Highest Migration Rates

Biggest Logistics Companies In the World

Best Paying Medical Jobs With Least Education

Disclosure: None