There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Dawson Geophysical Company (NASDAQ:DWSN).

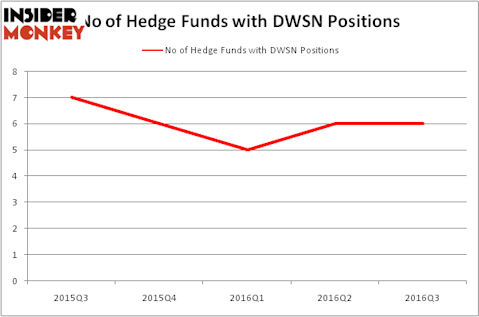

Hedge fund interest in Dawson Geophysical Company (NASDAQ:DWSN) shares was flat during the third quarter. This is usually a negative indicator. 6 hedge funds in our system were long the stock at the end of June and at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as JTH Holding Inc (NASDAQ:TAX), GlycoMimetics Inc (NASDAQ:GLYC), and Collectors Universe, Inc. (NASDAQ:CLCT) to gather more data points.

Follow Dawson Operating Co (NASDAQ:DWSN)

Follow Dawson Operating Co (NASDAQ:DWSN)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

What does the smart money think about Dawson Geophysical Company (NASDAQ:DWSN)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from the second quarter of 2016. On the other hand, there were a total of 7 hedge funds with a bullish position in DWSN a year earlier, so hedge fund sentiment has slipped slightly over the last year. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Beddow Capital Management, led by Ed Beddow and William Tichy, holds the number one position in Dawson Geophysical Company (NASDAQ:DWSN). Beddow Capital Management has a $15.3 million position in the stock, comprising 6.3% of its 13F portfolio. The second largest stake is held by Renaissance Technologies, one of the largest hedge funds in the world, which has a $10.5 million position. Other members of the smart money with similar optimism comprise Chuck Royce’s Royce & Associates, Gregory Fraser, Rudolph Kluiber, and Timothy Krochuk’s GRT Capital Partners, and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that GRT Capital Partners is among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.