Is BOK Financial Corporation (NASDAQ:BOKF) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

More recently hedge funds and other prominent investors are getting optimistic towards BOKF. The number of bullish hedge fund bets that are revealed through the 13F filings moved up by 1 in recent months. There were 11 hedge funds in our database with BOKF holdings at the end of June. At the end of this article we will also compare BOKF to other stocks including Calpine Corporation (NYSE:CPN), SYNNEX Corporation (NYSE:SNX), and Williams-Sonoma, Inc. (NYSE:WSM) to get a better sense of its popularity.

Follow Bok Financial Corp (NASDAQ:BOKF)

Follow Bok Financial Corp (NASDAQ:BOKF)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Nonwarit/Shutterstock.com

Now, we’re going to check out the new action encompassing BOK Financial Corporation (NASDAQ:BOKF).

What have hedge funds been doing with BOK Financial Corporation (NASDAQ:BOKF)?

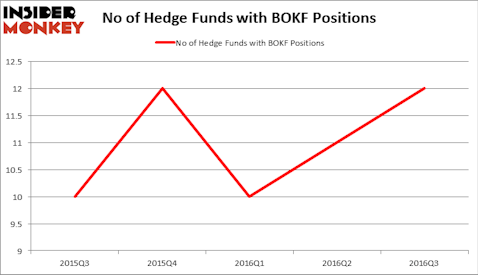

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of 9% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BOKF over the last 5 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ric Dillon’s Diamond Hill Capital has the largest position in BOK Financial Corporation (NASDAQ:BOKF), worth close to $68.5 million, comprising 0.4% of its total 13F portfolio. Sitting at the No. 2 spot is Royce & Associates, led by Chuck Royce, which holds a $28.5 million position; 0.2% of its 13F portfolio is allocated to the stock. Other members of the smart money that are bullish encompass John W. Rogers’s Ariel Investments, AQR Capital Management (one of the biggest hedge funds in the world) and Solomon Kumin’s Folger Hill Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.