Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

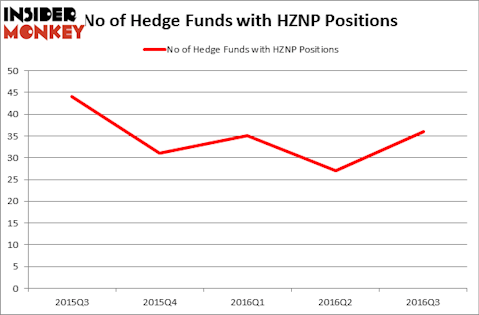

Is Horizon Pharma PLC (NASDAQ:HZNP) a healthy stock for your portfolio? Hedge funds are in a bullish mood. The number of long hedge fund bets moved up by 9 in recent months. HZNP was in 36 hedge funds’ portfolios at the end of the third quarter of 2016. There were 27 hedge funds in our database with HZNP holdings at the end of the previous quarter. At the end of this article we will also compare HZNP to other stocks including Kate Spade & Co (NYSE:KATE), Logitech International SA (USA) (NASDAQ:LOGI), and UMB Financial Corporation (NASDAQ:UMBF) to get a better sense of its popularity.

Follow Horizon Therapeutics Public Ltd Co (NASDAQ:HZNP)

Follow Horizon Therapeutics Public Ltd Co (NASDAQ:HZNP)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

racorn/Shutterstock.com

With all of this in mind, we’re going to review the new action regarding Horizon Pharma PLC (NASDAQ:HZNP).

How have hedgies been trading Horizon Pharma PLC (NASDAQ:HZNP)?

At the end of the third quarter, a total of 36 of the hedge funds tracked by Insider Monkey held long positions in this stock, a surge of 33% from the second quarter of 2016. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Kingdon Capital, managed by Mark Kingdon, holds the number one position in Horizon Pharma PLC (NASDAQ:HZNP). The fund reportedly holds a $123.6 million position in the stock, comprising 5.7% of its 13F portfolio. On Kingdon Capital’s heels is James E. Flynn of Deerfield Management, with a $116.7 million position; the fund has 5.4% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish include Kevin Kotler’s Broadfin Capital, Arthur B Cohen and Joseph Healey’s Healthcor Management LP and Mitchell Blutt’s Consonance Capital Management.

With a general bullishness amongst the heavyweights, key hedge funds have been driving this bullishness. Healthcor Management LP, managed by Arthur B Cohen and Joseph Healey, initiated the most valuable position in Horizon Pharma PLC (NASDAQ:HZNP). The fund had $77.1 million invested in the company at the end of the quarter. Mitchell Blutt’s Consonance Capital Management also initiated a $67.1 million position during the quarter. The other funds with new positions in the stock are Ken Heebner’s Capital Growth Management, Robert Pohly’s Samlyn Capital, and James Dondero’s Highland Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Horizon Pharma PLC (NASDAQ:HZNP). These stocks are Kate Spade & Co (NYSE:KATE), Logitech International SA (USA) (NASDAQ:LOGI), UMB Financial Corporation (NASDAQ:UMBF), and GrubHub Inc (NYSE:GRUB). This group of stocks’ market caps are similar to HZNP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KATE | 29 | 535210 | -1 |

| LOGI | 11 | 68379 | 3 |

| UMBF | 9 | 64230 | 1 |

| GRUB | 29 | 1110708 | 4 |

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $445 million. That figure was $741 million in HZNP’s case. Kate Spade & Co (NYSE:KATE) is the most popular stock in this table. On the other hand UMB Financial Corporation (NASDAQ:UMBF) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Horizon Pharma PLC (NASDAQ:HZNP) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: none.