“Market volatility has picked up again over the past few weeks. Headlines highlight risks regarding interest rates, the Fed, China, house prices, auto sales, trade wars, and more. Uncertainty abounds. But doesn’t it always? I have no view on whether the recent volatility will continue for a while, or whether the market will be back at all-time highs before we know it. I remain focused on preserving and growing our capital, and continue to believe that the best way to do so is via a value-driven, concentrated, patient approach. I shun consensus holdings, rich valuations, and market fads, in favor of solid, yet frequently off-the-beaten-path, businesses run by excellent, aligned management teams, purchased at deep discounts to intrinsic value,” are the words of Maran Capital’s Dan Roller. His stock picks have been beating the S&P 500 Index handily. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards Honeywell International Inc. (NYSE:HON) and see how it was affected.

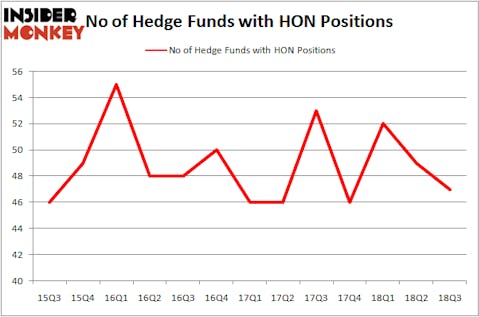

Honeywell International Inc. (NYSE:HON) investors should be aware of a decrease in hedge fund sentiment of late. On September 30, the stock was in 47 hedge funds portfolios, which represents a decrease of two, when compared to the previous quarter. HON was not one of the 30 most popular stocks among hedge funds in Q3 of 2018.

If you’d ask most traders, hedge funds are perceived as unimportant, old investment vehicles of the past. While there are more than 8000 funds trading today, We hone in on the masters of this club, about 700 funds. These hedge fund managers have their hands on bulk of the smart money’s total capital, and by tracking their finest investments, Insider Monkey has unearthed many investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 26.1% since February 2017 even though the market was up nearly 19% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

While collecting more data about Honeywell International Inc. (NYSE:HON), we found Gabelli Value 25 Fund’s 3rd Quarter Shareholder Letter, in which this fund talks about the company. Gabelli Value 25 Fund (which is managed by GAMCO Investors) is actually one of the company’s largest shareholders. We bring you one part of that report:

“Honeywell International Inc. (NYSE:HON)(3.3%) (HON – $166.40 – NYSE) operates as a diversified technology company with highly engineered products, including turbine propulsion engines, auxiliary power units, aircraft brake pads, environmental control systems, engine controls, communications and navigation systems, sensors, home automation, catalysts and absorbents and process technology for the petrochemical and refining industries and warehouse automation equipment and software. One of the key drivers of HON’s growth is acquisitions that increase the company’s growth profile globally, creating both organic and inorganic opportunities. The company recently announced its plan to spin-off its Homes product portfolio and ADI Global Distribution businesses as well as its Transportation Systems business into two publicly-traded companies.”

Continuing with our analysis, let’s take a glance at the latest hedge fund action surrounding Honeywell International Inc. (NYSE:HON).

How are hedge funds trading Honeywell International Inc. (NYSE:HON)?

Heading into the fourth quarter of 2018, a total of 47 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 4% from the previous quarter. The graph below displays the number of hedge funds with bullish position in HON over the last 13 quarters. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

The largest stake in Honeywell International Inc. (NYSE:HON) was held by Adage Capital Management, which reported holding $360.7 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $331.6 million position. Other investors bullish on the company included AQR Capital Management, GAMCO Investors, and Millennium Management.

Because Honeywell International Inc. (NYSE:HON) has faced a decline in interest from hedge fund managers, we can see that there exists a select few hedge funds who sold off their full holdings by the end of the third quarter. Interestingly, Jim Simons’s Renaissance Technologies sold off the biggest stake of the 700 funds watched by Insider Monkey, totaling an estimated $142.7 million in stock. Matthew Tewksbury’s fund, Stevens Capital Management, also dropped its stock, about $13.9 million worth. These transactions are intriguing to say the least, as total hedge fund interest fell by 2 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Honeywell International Inc. (NYSE:HON) but similarly valued. We will take a look at China Petroleum & Chemical Corp (NYSE:SNP), Union Pacific Corporation (NYSE:UNP), salesforce.com, inc. (NYSE:CRM), and BHP Group Plc (NYSE:BBL). All of these stocks’ market caps are closest to HON’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SNP | 13 | 284383 | -1 |

| UNP | 53 | 4921725 | 4 |

| CRM | 86 | 5615448 | 4 |

| BBL | 16 | 814748 | 2 |

As you can see these stocks had an average of 42 hedge funds with bullish positions and the average amount invested in these stocks was $2.91 billion. That figure was $2.45 billion in HON’s case. salesforce.com, inc. (NYSE:CRM) is the most popular stock in this table. On the other hand China Petroleum & Chemical Corp (NYSE:SNP) is the least popular one with only 13 bullish hedge fund positions. Honeywell International Inc. (NYSE:HON) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CRM might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.