Life is good for refiners right now. Crude prices are low, finished product prices are high, and the discrepancies in midstream infrastructure give the appearance that this trend could continue for a while. Of all the refiners out there, HollyFrontier Corp (NYSE:HFC) has serendipitously found itself in an ideal position to capitalize on the unconventional shale boom. Let’s check in with the company and see how it landed in this lucky spot.

The operational fits HollyFrontier Corp (NYSE:HFC) experienced this quarter are more than likely a one-time event, and not really an indication of the company’s health. Other smaller, independent refiners similar to HollyFrontier Corp (NYSE:HFC) had better-than-expected results for the quarter and expect to continue those results for the foreseeable future.

Just lucky, I guess

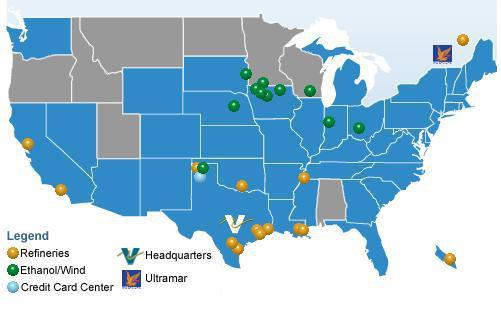

What may be considered a great stroke of luck could potentially be one of HollyFrontier Corp (NYSE:HFC)’s greatest competitive advantages going forward. Unlike large competitors Phillips 66 (NYSE:PSX) and Valero Energy Corporation (NYSE:VLO) , which have a majority of their refining capacity in the Gulf of Mexico or on the coasts, HollyFrontier’s five refineries are all located in the mid-continent, Rockies, and southwest regions, which puts them all smack-dab in the middle of the Mississippian Lime, Niobrara, Permian, and Uinta formations.

Valero Refining locations (Source: Company Website)

Phillips 66 US Operations, Red represents refineries (Source: Company Website)

HollyFrontier Operations, white squares represent refineries (Source: Company Website)

This could be a huge opportunity for the company for two reasons. First, these crudes won’t need to travel far, so the transportation costs to get them to the facilities could be much less than for its competitors that need to move it to their facilities.

Second, most of these unconventional plays lack sufficient capacity. So E&P companies that have leveraged their entire portfolios into a single play — think SandRidge Energy Inc. (NYSE:SD) and its 1.85 million acres in the Mississippian Lime — will need to rely heavily on local refiners to buy product. A bottlenecked market could lead to discounted prices for local crudes. Bad for E&P, very good for HollyFrontier.

As of right now, several of the younger shale plays, like the Mississippian lime and the Niobrara, have yet to deliver crude to HollyFrontier refiners, because the company’s refineries are currently designed to handle Western Canadian Select blend and Christina Lake crudes. This is probably due to change, though. CEO Michael Jennings recently stated in a conference call that he believes the company will start to see opportunity from these basins within a year. What also makes this path so attractive is that Gulf refiners such as Phillips 66 and Valero seem more keen on processing heavy oil from the Canadian oil sands rather than mid-continent crudes because of the oil sands’ similarity to its current feedstocks.

What a Fool believes

Despite those little operational hiccups this past quarter that dropped total throughput volumes, HollyFrontier still crushed year-over-year numbers thanks to those wonderful crack spreads the refining business experienced in 2012. Don’t be surprised if the company goes back to leaving earnings estimates in the dust next quarter. If the recent crack spreads and the potential market position aren’t enough to convince you of the opportunity with HollyFrontier, then perhaps its shareholder-friendly dividend will. The company just announced that it will raise its quarterly dividend by 50%, and management does have a history of giving out several special dividends throughout the year. I made an outperform call on CAPS for HollyFrontier already, but this is just further evidence that it’s a solid call.

The article This Lucky Refiner Could Make You Rich originally appeared on Fool.com and is written by Tyler Crowe.

Fool contributor Tyler Crowe has no position in any stocks mentioned. You can follow him at Fool.com under the handle TMFDirtyBird, on Google +, or on Twitter@TylerCroweFool. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.