Wasatch Global Investors, an asset management company, released its “Wasatch Micro-Cap Growth-U.S. Strategy” third-quarter 2024 investor letter. A copy of the letter can be downloaded here. In the quarter, U.S.-based micro-cap companies benefited from optimism surrounding decreasing interest rates and a smooth economic transition, which led to greater investor appetite for risk. The strategy appreciated and outperformed the benchmark Russell Microcap® Growth Index in the quarter, which returned 8.57%. In addition, please check the fund’s top five holdings to know its best picks in 2024.

Wasatch Micro-Cap Growth-U.S. Strategy highlighted stocks like Veeco Instruments Inc. (NASDAQ:VECO) in the third quarter 2024 investor letter. Veeco Instruments Inc. (NASDAQ:VECO) develops, manufactures, sells, and supports semiconductor process equipment. The one-month return of Veeco Instruments Inc. (NASDAQ:VECO) was -2.84%, and its shares lost 5.43% of their value over the last 52 weeks. On January 2, 2025, Veeco Instruments Inc. (NASDAQ:VECO) stock closed at $27.00 per share with a market capitalization of $1.53 billion.

Wasatch Micro-Cap Growth-U.S. Strategy stated the following regarding Veeco Instruments Inc. (NASDAQ:VECO) in its Q3 2024 investor letter:

“Veeco Instruments Inc. (NASDAQ:VECO) was another detractor. Veeco is a global capital–equipment supplier that designs and builds processing systems used to manufacture high-tech microelectronic devices, including semiconductors, photonics, display technologies and power supplies. We trimmed our position earlier in the year after the stock was bolstered by AI euphoria. Many of the stocks perceived as AI beneficiaries sold off during the period. However, fundamentals for Veeco remain solid in our view, and we used weakness in the stock price to build back our position size.”

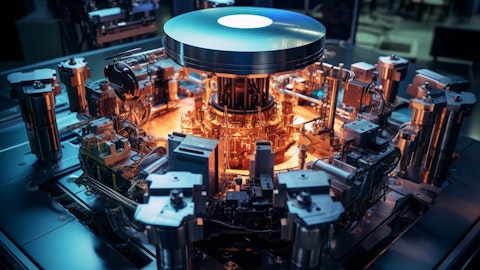

A one of a kind semiconductor process equipment machine with various parts and components.

Veeco Instruments Inc. (NASDAQ:VECO) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 24 hedge fund portfolios held Veeco Instruments Inc. (NASDAQ:VECO) at the end of the third quarter which was 24 in the previous quarter. Veeco Instruments Inc.’s (NASDAQ:VECO) revenue reached $185 million in the third quarter, surpassing the midpoint of forecast, representing a 4% increase compared to the previous year and a 5% rise from the prior quarter. While we acknowledge the potential of Veeco Instruments Inc. (NASDAQ:VECO) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Veeco Instruments Inc. (NASDAQ:VECO) and shared the list of AI stocks that are on sale. In addition, please check out our hedge fund investor letters Q3 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.