TimesSquare Capital Management, an equity investment management company, released its “U.S. SMID Cap Growth Strategy” third-quarter investor letter. The same can be downloaded here. In the third quarter, the U.S. SMID Cap Growth Composite fell -2.65% (gross) and -2.89% (net) compared to the Russell 2500 Growth Index’s -6.84% decline. This quarter, the small-to-mid-cap growth stocks that performed better had lower betas or higher returns on equity. Stocks that lacked short-term earnings or had exorbitant valuations (as measured by price/earnings) were penalized. In the third quarter, the portfolio beat the Russell 2500 Growth Index in this setting. In addition, please check the fund’s top five holdings to know its best picks in 2023.

TimesSquare Capital U.S. SMID Cap Growth Strategy highlighted stocks like MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) in the third quarter 2023 investor letter. Headquartered in Lowell, Massachusetts, MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) designs and manufactures analog semiconductor solutions. On December 26, 2023, MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) stock closed at $95.51 per share. One-month return of MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) was 14.34%, and its shares gained 57.22% of their value over the last 52 weeks. MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) has a market capitalization of $6.869 billion.

TimesSquare Capital U.S. SMID Cap Growth Strategy made the following comment about MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) in its Q3 2023 investor letter:

“Among the wide variety of Information Technology companies, we prefer critical system providers, specialized component designers, and systems that improve productivity or efficiency for their clients. Late in the quarter, MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) reported results that were largely in line with expectations for this designer of radio frequency, millimeter wave, microwave and photonic analog semiconductor chips for the aerospace/defense, communication network, and datacenter markets. The market seemed enthusiastic regarding increased guidance for its final quarter of the fiscal year, and the surging growth of its datacenter business. Later, there were additional rewards for MACOM after it announced the acquisition of Wolfspeed’s complementary radio frequency business. While the deal makes strategic sense, because MACOM will fund the purchase partly with shares, we pruned our position as it gained 24%.”

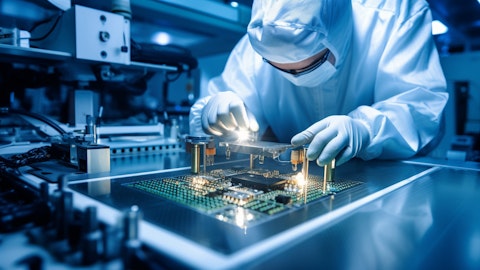

An aerial view of a semiconductor factory, with its intricate machinery and equipment.

MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 13 hedge fund portfolios held MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) at the end of third quarter which was 17 in the previous quarter.

We discussed MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) in another article and shared Artisan Small Cap Fund’s views on the company. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 25 Best Red Wines of 2023 For Casual Drinking

- 13 Best IPO Stocks to Buy Heading into 2024

- 20 Most Expensive Bottled Water Brands In The World

Disclosure: None. This article is originally published at Insider Monkey.