Fred Alger Management, an investment management company, released its “Alger Weatherbie Specialized Growth Fund” first quarter 2024 investor letter. A copy of the letter can be downloaded here. US markets performed strongly in Q1, with the S&P Index up 10.56%. Investor confidence rose with the anticipated soft landing of the market. However, Class A shares of the fund underperformed the Russell 2500 Growth Index in the quarter. Communication services and real estate sectors boosted the relative performance while information technology and industrials weighed down. In addition, you can check the top 5 holdings of the fund to know its best picks in 2024.

Alger Weatherbie Specialized Growth Fund highlighted stocks like Nevro Corp. (NYSE:NVRO), in the first quarter 2024 investor letter. Nevro Corp. (NYSE:NVRO) is a medical device company. Nevro Corp.’s (NYSE:NVRO) one-month return was -16.14%, and its shares lost 66.02% of their value over the last 52 weeks. On May 31, 2024, Nevro Corp. (NYSE:NVRO) stock closed at $9.35 per share with a market capitalization of $343.412 million.

Alger Weatherbie Specialized Growth Fund stated the following regarding Nevro Corp. (NYSE:NVRO) in its first quarter 2024 investor letter:

“Nevro Corp. (NYSE:NVRO) provides spinal cord stimulation (SCS) devices in the U.S. and internationally for patients suffering from chronic pain. The global SCS market exceeds $2 billion and has been growing due to increased investment by the industry. During the quarter, the company preannounced fiscal fourth quarter results where revenues beat consensus estimates. Moreover, the company noted that while staffing issues and payer pressures continue to linger, the actual impact to procedure volumes appears to be declining. However, management noted that they remain cautious on the core SCS market, which still has a ways to go to get back to pre-pandemic levels. As such, shares detracted from performance.”

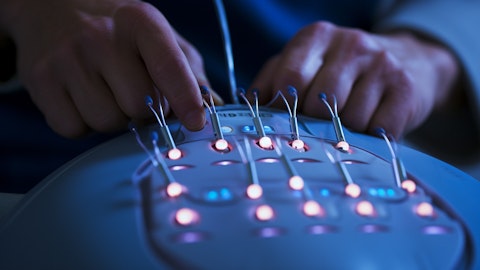

A closeup of electrodes being used to deliver the 10 kHz Therapy spinal cord stimulation system to a patient.

Nevro Corp. (NYSE:NVRO) reported worldwide revenue of $101 million in the first quarter, an increase of 5.8% as reported and 5.6% on a constant currency, driven by a shift to higher-margin products and growing number of patients.

Nevro Corp. (NYSE:NVRO) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 29 hedge fund portfolios held Nevro Corp. (NYSE:NVRO) at the end of the first quarter which was 21 in the previous quarter.

In another article, we discussed Nevro Corp. (NYSE:NVRO) and shared the list of stocks that billionaire Steve Cohen bought aggressively. In addition, please check out our hedge fund investor letters Q1 2024 page for more investor letters from hedge funds and other leading investors.

If you are looking for an AI stock that is as promising as Microsoft but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.