Fred Alger Management, an investment management company, released its “Alger Mid Cap Focus Fund” third quarter 2024 investor letter. A copy of the letter can be downloaded here. U.S. equity markets were favorable in the third quarter of 2024 driven by a dovish monetary policy shift by the Federal Reserve (Fed) and anticipation of a soft economic landing. At the same time, Class A shares of the fund underperformed the Russell Midcap Growth Index in the quarter. In addition, please check the fund’s top five holdings to know its best picks in 2024.

Alger Mid Cap Focus Fund highlighted stocks like Micron Technology, Inc. (NASDAQ:MU), in the third quarter 2024 investor letter. Micron Technology, Inc. (NASDAQ:MU) designs, develops, manufactures, and distributes memory and storage products globally. The one-month return of Micron Technology, Inc. (NASDAQ:MU) was -6.97%, and its shares gained 26.76% of their value over the last 52 weeks. On November 19, 2024, Micron Technology, Inc. (NASDAQ:MU) stock closed at $97.73 per share with a market capitalization of $108.357 billion.

Alger Mid Cap Focus Fund stated the following regarding Micron Technology, Inc. (NASDAQ:MU) in its Q3 2024 investor letter:

“Micron Technology, Inc. (NASDAQ:MU) is a leading provider of innovative memory and storage solutions supporting key trends like AI, 5G, machine learning, and autonomous vehicles. Micron’s portfolio includes high-bandwidth memory (HBM), which is critical for efficient AI workloads, along with storage solutions like DRAM, NAND, and NOR. These are sold in various forms such as wafers, components, modules, SSDs (solid-state drives), and MCPs (multi-chip packages). We believe the company is well-positioned to potentially benefit from secular trends in AI, data centers, cloud computing, and 5G markets. In July, shares detracted from performance after management lowered expectations due to the slower-than-expected pace of clearing excess inventory. Weak demand in markets like PCs and smartphones led to lower shipment forecasts for the next fiscal quarter. However, towards the end of the quarter, Micron reported better-than-expected fiscal fourth-quarter results, driven by strong data center demand and continued growth in AI-leveraged HBM sales. Although the share price rose after the announcement, shares were still down overall for the quarter.”

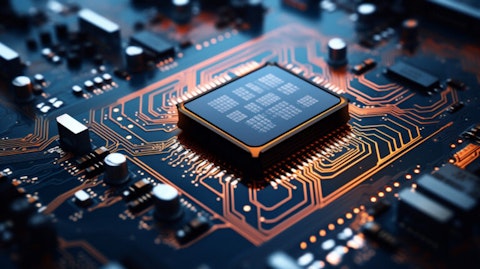

A close-up view of a computer motherboard with integrated semiconductor chips.

Micron Technology, Inc. (NASDAQ:MU) is in 16th position on our list of 31 Most Popular Stocks Among Hedge Funds. As per our database, 107 hedge fund portfolios held Micron Technology, Inc. (NASDAQ:MU) at the end of the third quarter which was 120 in the previous quarter. While we acknowledge the potential of Micron Technology, Inc. (NASDAQ:MU) as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as NVIDIA but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

In another article, we discussed Micron Technology, Inc. (NASDAQ:MU) and shared the list of stocks that could 10x over the next 3 years. In addition, please check out our hedge fund investor letters Q3 2024 page for more investor letters from hedge funds and other leading investors.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. This article is originally published at Insider Monkey.