We recently published a list of 10 AI Stocks to Watch Amid DeepSeek Impact. In this article, we are going to take a look at where Marvell Technology Inc (NASDAQ:MRVL) stands against other AI stocks to watch amid DeepSeek impact.

The launch of DeepSeek is drawing new battle lines in the AI competition and many analysts believe the technology investment landscape won’t be the same again after the Chinese breakthrough. Talking to CNBC, Databricks CEO Ali Ghodsi said that DeepSeek would result in “distillation” where companies will make smaller, more efficient models based on the technology:

“So we’re going to just see distillation happening left and right. It’s already happening—like, there’s so many versions of DeepSeek that have been reproduced and redone just in the last week as we speak. So this distillation is going to just create so much competition at the LLM or the AI layer.”

In the coming days, it would be interesting to see how American AI companies tackle this challenge and come up with new products or breakthroughs to maintain their dominance.

READ ALSO 7 Best Stocks to Buy For Long-Term and 8 Cheap Jim Cramer Stocks to Invest In

For this article, we picked 10 AI stocks that are trending on the back of latest news. With each stock we have mentioned the number of hedge fund investors. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

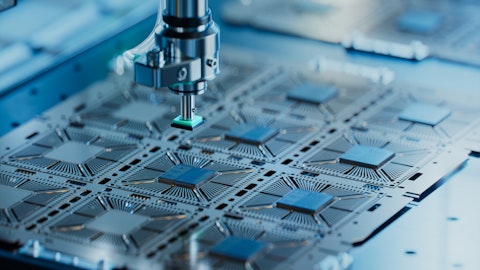

Close-up of Silicon Die are being Extracted from Semiconductor Wafer and Attached to Substrate by Pick and Place Machine. Computer Chip Manufacturing at Fab. Semiconductor Packaging Process.

Marvell Technology Inc (NASDAQ:MRVL)

Number of Hedge Fund Investors: 70

Shana Sissel from Banríon Capital Management explained in a latest program on Schwab Network why she likes Marvell Technology Inc (NASDAQ:MRVL) stock as an AI play:

“Marvell, in particular, gets a bad rep. The stock does really well, and I was looking at some of the Street research and expectations for the stock. It’s really mixed—there are people who love the stock or really hate the stock. The company has, you know, a bit of leverage on their balance sheet, but overall it is taking advantage of trends in the industry, particularly as it pertains to 5G and custom silicon for AI. That should do really well, and if you look at its data center business, it’s just done remarkably well—really performed at a high level. So, it’s a stock that I really like because not a lot of people pay attention to it, but it is an AI play.”

Marvell Technology Inc (NASDAQ:MRVL) is rapidly positioning itself as an AI-first company, with its custom silicon business accounting for 73% of Q3 revenues, up from 39% during the same period last year. Marvell has a five-year agreement with Amazon (AMZN) AWS, helping Amazon design its Trainium and Inferentia ASICs, and providing a range of optical interconnect products.

Marvell Technology Inc (NASDAQ:MRVL) is now focusing on the AI opportunity, as evidenced by the recent restructuring charges, and is progressing through the design phase of its 2nm platform.

Carillon Eagle Mid Cap Growth Fund stated the following regarding Marvell Technology, Inc. (NASDAQ:MRVL) in its Q4 2024 investor letter:

“Marvell Technology, Inc. (NASDAQ:MRVL) is a leading provider of semiconductor chips for data centers. This past quarter, management highlighted very strong orders coming from customers in the artificial intelligence (AI) space as well as design wins for future AI-related chips. Management shared a long-term view for a revenue target that was above expectation.”

Overall, MRVL ranks 8th on our list of AI stocks to watch amid DeepSeek impact. While we acknowledge the potential of MRVL, our conviction lies in the belief that under the radar AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than MRVL but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap

Disclosure: None. This article is originally published at Insider Monkey.