Longleaf Partners, managed by Southeastern Asset Management, released its “Small-Cap Fund” fourth-quarter investor letter. A copy of the same can be downloaded here. The fund delivered 4.74% in the fourth quarter compared to a 6.23% return for the Russell 2000 Index, while the fund declined -19.27% in the year 2022. Multiple companies across sectors delivered strong returns and positive relative performance in the fourth quarter. In addition, please check the fund’s top five holdings to know its best picks in 2022.

Longleaf Partners Small-Cap Fund highlighted stocks Lumen Technologies, Inc. (NYSE:LUMN) in the Q4 2022 investor letter. Headquartered in Monroe, Louisiana, Lumen Technologies, Inc. (NYSE:LUMN) is a technology and communications company that provides various integrated products and services. On February 3, 2023, Lumen Technologies, Inc. (NYSE:LUMN) stock closed at $5.26 per share. One-month return of Lumen Technologies, Inc. (NYSE:LUMN) was -2.41%, and its shares lost 58.05% of their value over the last 52 weeks. Lumen Technologies, Inc. (NYSE:LUMN) has a market capitalization of $5.442 billion.

Longleaf Partners Small-Cap Fund made the following comment about Lumen Technologies, Inc. (NYSE:LUMN) in its Q4 2022 investor letter:

“Lumen Technologies, Inc. (NYSE:LUMN) – Global fiber company Lumen was the top absolute and relative detractor for both periods. This long-term position had a history of managing costs and producing steady free cash flow under the leadership of former CEO Jeff Storey, but its organic revenue growth has been disappointing for a few years and its cash flow began to disappoint recently. In September, the company announced a new CEO, Kate Johnson, would take over. Although her experience at Microsoft and proven track record of delivering organic growth make her a good fit for the role, the communication of her hire was mishandled. The stock price declined on the initial news and fell further as a previously feared dividend cut was announced in November. Lumen also announced in November the positive news of the planned sale of its Europe business for 11x EBITDA (when the whole company is now selling at 5x EBITDA) and a $1.5 billion share repurchase authorization, on top of closing on the previously announced sale of part of its consumer business to Apollo in October. The recent moves are creating a clearer business mix and stronger balance sheet, and we believe we could see additional positive moves to finally separate the legacy Level 3/Qwest business from the remaining quality local market assets.”

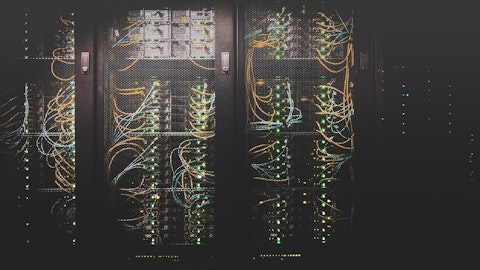

Pixabay/Public domain

Lumen Technologies, Inc. (NYSE:LUMN) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 34 hedge fund portfolios held Lumen Technologies, Inc. (NYSE:LUMN) at the end of the third quarter, which was 42 in the previous quarter.

We discussed Lumen Technologies, Inc. (NYSE:LUMN) in another article and shared the list of lowest P/E ratios of the S&P 500. In addition, please check out our hedge fund investor letters Q4 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- Michael Burry Stock Portfolio: 10 Stocks He Sold

- 12 Countries that Export the Most Tea

- 15 Countries that Export the Most Beef

Disclosure: None. This article is originally published at Insider Monkey.