Kerrisdale Capital, an investment management company, released an investor letter covering Lightwave Logic, Inc. (NASDAQ:LWLG) in June. A copy of the same can be downloaded here. Kerrisdale Capital has a short position in Lightwave Logic, Inc. (NASDAQ:LWLG). You can check the top 5 holdings of the fund to know its best picks in 2022.

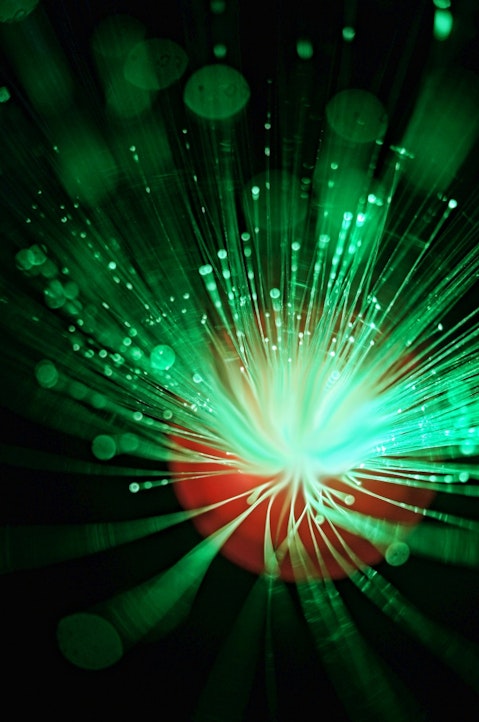

Headquartered in Englewood, Colorado, Lightwave Logic, Inc. (NASDAQ:LWLG) is a development company that develops electro-optic photonic devices. On August 24, 2022, Lightwave Logic, Inc. (NASDAQ:LWLG) stock closed at $10.16 per share. One-month return of Lightwave Logic, Inc. (NASDAQ:LWLG) was 3.78% and its shares gained 35.47% of their value over the last 52 weeks. Lightwave Logic, Inc. (NASDAQ:LWLG) has a market capitalization of $1.139 billion.

Here is what Kerrisdale Capital said about Lightwave Logic, Inc. (NASDAQ:LWLG):

“We are short shares of Lightwave Logic, Inc. (NASDAQ:LWLG), a $900 million “electro-optic photonic device” company that has been perpetually stuck in “development stage” status for more than thirty years. The company’s stock price rose by 10x in June of last year, in tandem with some well-timed investment conference presentations, excitable message board postings from long-suffering shareholders, and an extremely favorable environment for retail-driven stock frenzies. Since then, Lightwave has been able to maintain at least some of those gains through a NASDAQ uplisting and a steady stream of optimistic press releases touting supposedly successful product tests and patent issuances.

Underneath the façade of accomplishment, though, is almost nothing of substance. Lightwave claims its “products” will enable optical communications speeds 2-3x the current industry standards using a fraction of the power. But Lightwave hasn’t ever come close to commercializing anything: in the 15 years since it’s gone public, it has generated a total of about $6 thousand in revenues, which stands in stark contrast to the steady stream of promotional announcements celebrating overhyped prototype completions, product tests, and patents over that time. Somehow, success in the lab – none of which we could find reviewed or published in any of the industry’s scientific journals – hasn’t translated into a single commercial product.

In the same vein, the device specs that Lightwave ambiguously discloses in its announcements and presentations are just not very impressive. The supposed bandwidth capabilities of its stand-alone prototype modulator enable data transmission speeds that are lower than those that have been achieved by entire transceivers (a much higher hurdle) from prominent industry players like Acacia and Infinera. Furthermore, while Lightwave frequently points out that polymer-based modulators would consume a fraction of the power that standard modulators do, this is completely irrelevant because modulation accounts for less than 5% of the power consumption of a typical transceiver. In other words, even if Lightwave had a marketable product, it would be inferior to what is already manufactured in much smaller physical size and at much larger industry scale…” (Click here to read more)

Lightwave Logic, Inc. (NASDAQ:LWLG) is in not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 6 hedge fund portfolios held Lightwave Logic, Inc. (NASDAQ:LWLG) at the end of the first quarter which was 10 in the previous quarter.

In addition, please check out our hedge fund investor letters Q2 2022 page for more investor letters from hedge funds and other leading investors.

Disclosure: None. This article is originally published at Insider Monkey.