It seems like Deja Vu all over again as pollsters and conventional wisdom were again proven wrong. Less than five months after the pro-Brexit side shocked the world, the Trump campaign defied the odds again by winning the White House.

Given that Trump will become the most powerful person in the world for the next four years, the news of his impending ascension has caused massive changes in various sectors. In addition to company specific news, let’s take a look at how the changes will affect Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA), Amazon.com, Inc. (NASDAQ:AMZN), Exxon Mobil Corporation (NYSE:XOM), Chevron Corporation (NYSE:CVX), and Total SA (ADR) (NYSE:TOT). Let’s also examine how the investors from our database were positioned towards the five stocks.

While there are many metrics that investors can assess in the investment process, the hedge fund sentiment is something that is often overlooked. However, hedge funds and other institutional investors allocate significant resources while making their bets and their long-term focus makes them the perfect investors to emulate. This is supported by our research, which determined that following the small-cap stocks that hedge funds are collectively bullish on can help a smaller investor to beat the S&P 500 by around 95 basis points per month (see the details here).

Joe Ravi / Shutterstock.com

Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA) shares have popped 5% due to improved sentiment. Given that Trump hasn’t talked as much about reigning in drug prices as Clinton has, some traders believe that Teva will do better under a Trump Presidency. In addition, on the account that Trump having said he will roll back government regulations, other traders think that the probability that the Department of Justice will charge Teva and other generic drug manufacturers with collusion will be lower. Of the 749 elite funds we track, 55 funds owned $6.21 billion of Teva Pharmaceutical Industries Ltd (ADR) (NYSE:TEVA) and accounted for 13.50% of the float on June 30, versus 70 funds and $7.34 billion respectively on March 31.

Follow Teva Pharmaceutical Industries Ltd (NYSE:TEVA)

Follow Teva Pharmaceutical Industries Ltd (NYSE:TEVA)

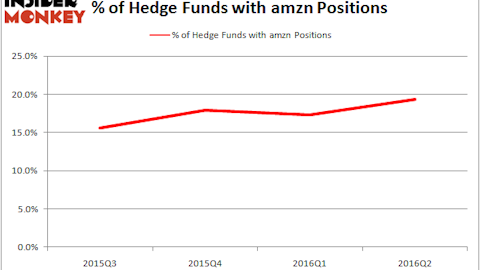

Receive real-time insider trading and news alerts

Amazon.com, Inc. (NASDAQ:AMZN) has retreated more than 2.7% due to Trump previously having said about the e-commerce giant: “Amazon is getting away with murder tax-wise.” Trump also mentioned Amazon’s CEO Jeff Bezos in the past, saying that: “Because he’s got a huge antitrust problem because he’s controlling so much, Amazon is controlling so much of what they are doing.” Although it is unclear whether Trump will act on his statements, many traders are now cautious on the stock given the new political climate on the Hill. If Amazon comes under more government scrutiny, its growth could slow. Ken Fisher’s Fisher Asset Management trimmed its position in Amazon.com, Inc. (NASDAQ:AMZN) by 1% to 1.98 million shares in the third quarter .

Follow Amazon Com Inc (NASDAQ:AMZN)

Follow Amazon Com Inc (NASDAQ:AMZN)

Receive real-time insider trading and news alerts

On the next page, we find out why Exxon Mobil Corporation, Chevron Corporation, and Total SA (ADR) are trending.